Oct 19, 2022

Elliott Takes Stake in Health-Care Firm Fresenius

, Bloomberg News

(Bloomberg) -- Elliott Investment Management has taken a stake in Fresenius SE & Co. with a view to potentially untangling the sprawling health-care company, people familiar with the matter said.

The Paul Singer-led firm has a substantial position in Bad Homburg, Germany-based Fresenius, the people said, asking not to be identified discussing confidential information. It hasn’t yet crossed the 3% disclosure threshold under German securities rules.

Shares in Fresenius rose as much as 12% on Wednesday. The stock was up 7.4% at 2:06 p.m. in Frankfurt, giving the company a market value of €12.5 billion ($12.2 billion).

Spokespeople for Elliott and Fresenius declined to comment.

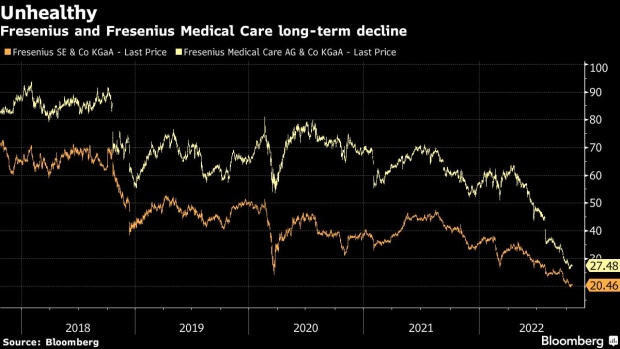

Elliott’s move raises the prospect of a break-up of a conglomerate whose structure has long been viewed as too complex and inefficient by some shareholders. They’ve watched its shares lose more than two thirds of their value over the last five years but seen little sign of major changes by management to address the fall.

Fresenius has four main businesses: as well as intravenous drug division Kabi and hospital chain Helios, it owns 32% of dialysis unit Fresenius Medical Care and a majority stake in Vamed, which manages the construction and operation of health-care centers.

A strategic review of these operations by previous Chief Executive Officer Stephan Sturm failed to result in any significant overhaul. Things may be different under Michael Sen, a former E.ON SE and Siemens AG executive with a reputation for not shying away from necessary change, who replaced Sturm earlier this month.

“None of us can be satisfied with the performance of the past years,” Sen said in a recent video posted on YouTube. “The more we embrace a positive attitude towards necessary change, the stronger we will become.”

Sen will address analysts for the first time as CEO on Nov. 1, when Fresenius reports earnings for the third quarter.

As one of Europe’s busiest activist investment firms, Elliott has previously run successful campaigns at German companies including industrial conglomerate Thyssenkrupp AG and software giant SAP SE.

Doing so at Fresenius might prove more difficult because of a KGaA group structure that gives special rights the foundation of the late Else Kroener, who led the company for more than 40 years until her death in 1988. The foundation has in the past resisted sweeping overhauls to Fresenius’s structure, the people said.

In a research note published in August, Metzler Capital Markets analyst Alexander Neuberger wrote that a portfolio reshuffle at Fresenius was “more appealing than ever,” in part because of poor performance and outlook for Fresenius Medical Care.

(Adds shares in third paragraph.)

©2022 Bloomberg L.P.