Jun 21, 2021

EU Gas Stokes Inflation Fears With Prices Near 13-Year High

, Bloomberg News

(Bloomberg) -- European natural gas extended its unprecedented rally as supply curbs sent prices to the highest in almost 13 years and stoked concerns over energy inflation.

Benchmark futures in the Netherlands on Monday rose 1.9% to the highest since 2008, extending this year’s rally. That comes after a longer- and colder-than-usual winter left gas storage sites across the continent depleted, while heavy maintenance in Norway is limiting flows and LNG imports to Europe decline.

EUROPE GAS OUTAGES: Skarv Gas Availability Cut by 15 Mcm/d

“EU traders are not selling at all,” said Sarah Behbehani, a former LNG trading executive who is now managing director at BEnergy Solutions DMCC in Dubai. The Dutch gas market is “pricing in anxiety and fear right now,” she said.

The gains are fueling concerns about inflation as commodity price increases prompt some analysts to say the market has entered a new supercycle. Gas is so scarce in Europe that some utilities have turned to burning more coal, a setback for the fight against climate change just a few months before the world’s leaders meet for a key summit in Scotland.

Dutch futures for next month jumped to 29.90 euros a megawatt-hour on the Title Transfer Facility hub on Monday, exceeding the previous intraday high of 29.675 euros in 2018. Such high prices are unusual in the summer, when demand for the heating is lower, raising the specter of further gains before the winter. Dutch futures are also at the widest premium above Henry Hub since 2013.

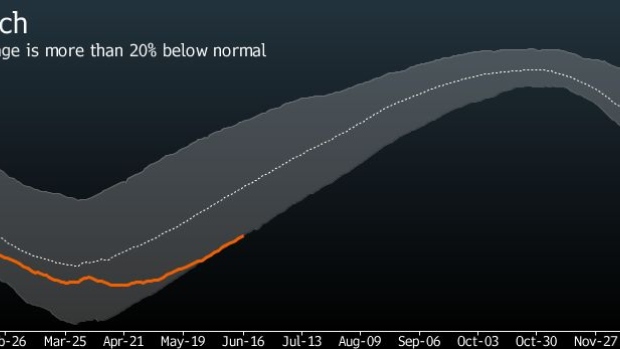

Gas inventories in Europe are more than 20% below normal, according to Gas Infrastructure Europe. Reserves are likely to peak at slightly above 90 billion cubic meters at the end of October, the bottom of the five-year range, assuming weather patterns in line with those of the past decade, according to Citigroup.

The supply concerns have also been fueled by key producer Russia, which has been flowing less gas to Europe via Ukraine ahead of the start of the Nord Stream 2 pipeline that will bypass the eastern European nation.

Furthermore, soaring demand in China means liquefied natural gas cargoes are being diverted to Asia. A drought in Brazil, which normally gets much of its power from hydroelectric dams, has increased global competition for LNG, while there is a risk that the hurricane season may disrupt supply of the liquid fuel from the U.S.

Prices didn’t move much after Gazprom booked all of the offered additional daily capacity of 15 million cubic meters for natural gas transit via Ukraine to European consumers in July. Another critical auction is planned for next week. In the last auction in May, Gazprom didn’t book any of the additional pipeline capacity Ukraine offered, despite the increasing gas demand in Europe.

Why World Frets Over Russian Nord Stream 2 Pipeline: QuickTake

Then there’s the climate angle. The European Union’s planned reform of the market next month could see prices for pollution permits that are already near a record high rise a further 20% by the end of the year, according to Macquarie Group Ltd. That is bullish for gas as it increases the attractiveness of the fuel relative to dirtier coal in power generation.

Higher natural gas prices support power prices, with gas being one of the main sources of electricity in Europe, specially when renewables and nuclear output are low. German 2022 power climbed 1.4% to EU66.95/MWh on EEX at 4:43 p.m. in Berlin, extending the 5.4% increase it has had so far in June. In Spain, where power prices reached their fourth-highest level on record last week, the government is considering suspending some energy taxes to soften the blow for households.

High EU Power Prices Threaten to Hurt Pandemic-Hit Consumers

Bulls might refrain later in the second half as some traders expect suppliers to respond to the tight market situation.

“We are bearish on TTF. We see a rebound in every element of EU’s gas supplies, in comparison to the low levels of last year,” said James Huckstepp, manager for Europe, Middle East and Africa gas analytics at S&P Global Platts.

(Updates prices in 11th paragraph, Ukraine auction result in ninth)

©2021 Bloomberg L.P.