Jun 8, 2022

Euro-Area Inflation Is Set to Peak in Third Quarter

, Bloomberg News

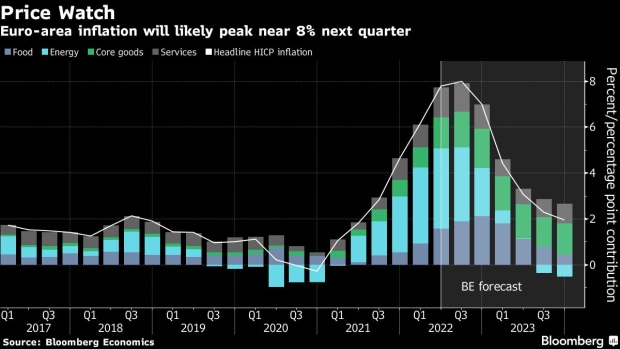

(Bloomberg) -- While headline inflation in the euro area is running at similar rates to the US, the composition is quite different: Energy accounts for the bulk of the spike this year, with more modest contributions from goods and services costs. Bloomberg Economics sees inflation peaking at close to 8% in the third quarter, before falling back through 2023. Price gains won’t return to the European Central Bank’s 2% target until the end of next year. There are two upside risks: Russia has strong incentives to engineer another spike in energy costs as winter nears, and high inflation could interact with a tight labor market to lift wage growth -- the latter is probably the ECB’s bigger fear because policymakers would be forced to lift rates faster.

Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

©2022 Bloomberg L.P.