Apr 12, 2024

Euro Falls to Five-Month Low as ECB-Fed Divergence Looms Large

, Bloomberg News

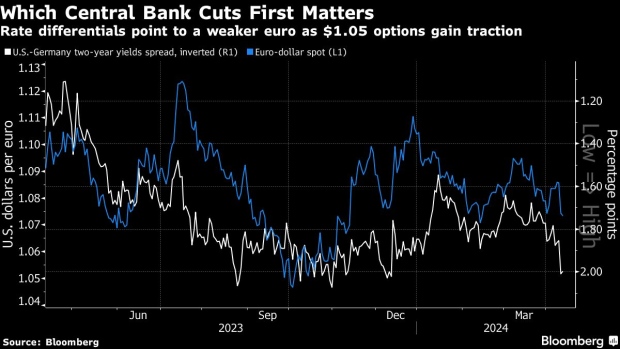

(Bloomberg) -- The euro fell to its lowest level this year as the European Central Bank looks set to cut interest rates before the Federal Reserve, fueling market discussion of just how much further it could fall.

The common currency dropped nearly 1% to $1.0631 on Friday, breaching the previous low of the year set in February and reaching the weakest in five months. It’s headed for a 2% weekly decline, which would be the worst since late 2022.

The selloff, which follows the ECB’s clearest signal yet rate cuts are looming, is fueling talk among strategists that the euro can fall further to $1.05 by mid-year and even reach parity if the Fed stays on hold this year. Banks including Bank of America Corp. ING Bank NV and Germany’s LBBW have already warned on the risk.

“We cannot exclude that a return to a $1 to $1.05 area,” Francesco Pesole, strategist at ING Bank NV in London, wrote in a note. A move toward parity would be possible “in an extreme Fed-ECB divergence scenario.”

Adding to pressure on Friday were reports that Israel is bracing for a possible attack from Iran, which boosted demand for the safe-haven dollar.

“The break of $1.07 was key, so it points to a move to $1.05 or even $1.04,” said Brad Bechtel, global head of FX at Jefferies in New York. His base case is for the euro to hit these levels as the ECB begins its easing cycle. “But if we get a further increase in geopolitical risk, then the USD will push the euro and other currencies even lower.”

The ECB is bucking a global repricing toward fewer and slower interest-rate cuts triggered by Wednesday’s hotter-than-expected US inflation data. While traders pushed back the expected start date for the Fed first cut by one meeting to September, they stuck to wagers that euro-area officials will deliver a quarter-point cut in June.

The divergent outlook for rates in both sides of the Atlantic has sent the yield spread between 10-year Treasuries and German bonds to the highest since late 2019.

“We believe the unprecedented monetary policy divergence to be the single most important negative for euro-dollar in coming months,” said Valentin Marinov, head of G-10 currency strategy at Credit Agricole. The break below $1.07 opened the door for a fall to $1.05 in the run-up to the ECB’s June meeting, he said.

Traders are also growing bearish. One-month risk reversals — a barometer of market positioning — point to the most negative sentiment toward the euro since October. Also three- and six-month implied volatility in the pair climbed to the highest in two months, indicating ample swings ahead.

According to Bloomberg’s forecast model, it’s now more probable than not that the euro touches the $1.05 handle within the next three months.

“The next key level below $1.07 is $1.05. If we get to this level, then we could hear talk about parity,” said Kathleen Brooks, research director at XTB.

(Adds comment, details on Treasury/Bund spreads, and updates prices.)

©2024 Bloomberg L.P.