Apr 13, 2023

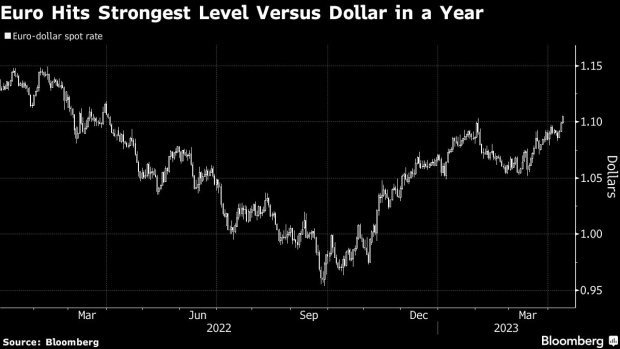

Euro Surges to Strongest in a Year as Fed-Cut Bets Batter Dollar

, Bloomberg News

(Bloomberg) -- The euro jumped to its highest level in more than a year as the dollar dived against its major developed market peers, fueled by increasing market expectations that a worsening US economic situation will prompt the Federal Reserve to cut interest rates later this year.

Europe’s common currency rose as much as 0.7% to $1.1068, a level last seen in April 2022, while the British pound touched a year-to-date high of $1.2537. The New Zealand and Australian dollars were the biggest gainers along with the Norwegian krone and the Swiss franc, while the Bloomberg dollar index declined as much as 0.7% to its lowest mark since early February.

The moves gained additional momentum in the US morning after producer price index data that showed reduced inflationary pressures. Investors had already turned more confident the Fed will cut interest rates later this year after data Wednesday showed US consumer-price inflation decelerated more than expected and the minutes of the central bank’s March meeting revealed policymakers scaled back expectations for rate hikes this year after a series of bank collapses roiled markets.

“There’s a lot of focus on the probability that the Fed could be cutting by the end of the year,” said Jane Foley, a senior foreign-exchange strategist at Rabobank. “The market is celebrating that.”

The Bloomberg Dollar Spot Index has fallen more than 10% since reaching an all-time high in September, and after a short-lived rally earlier this year it resumed its downward trend in mid-March, when the collapse of three US lenders sparked fears of a global banking crisis. Tighter financial conditions have led investors to rethink their expectations for interest rates around the world, paring bets on aggressive tightening by the Fed and its main counterparts.

The Australian dollar spiked as much as 1.6% to 0.6797 against the dollar, the highest level since Feb. 24. The Aussie was supported by domestic labor data highlighting economy’s resilience in the face of aggressive rate hikes.

Swap rates tied to Fed meeting dates suggest that officials are more likely than not to raise rates by another quarter point at their May meeting, but then proceed to lower the benchmark by year-end to a level more than half a point below the current effective fed funds rate.

The dollar weakness has lifted investor sentiment toward the euro, with three-week risk reversals versus the dollar — a tenor that captures the next monetary policy decisions by the Fed and the European Central Bank — reaching the least bearish levels since February 2022.

“The markets are expecting further divergence between the hawkish ECB and the peaking Fed,” said Credit Agricole foreign-exchange strategist Valentin Marinov. “That said, I think that the divergence has reached extreme proportions,” noting that he sees growing downside risks to the euro versus the dollar.

--With assistance from Vassilis Karamanis and Anya Andrianova.

(Updates pricing throughout.)

©2023 Bloomberg L.P.