Sep 7, 2022

Europe Faces Even Tougher Winters Ahead From Putin’s Gas Squeeze

, Bloomberg News

(Bloomberg) -- While European politicians are focusing on the region’s survival this winter, next year could be worse.

The loss of Russian natural-gas supplies will cause reserves to be depleted faster when temperatures drop in the coming months and make the process of preparing for following heating seasons even more difficult. With no quick fix available, the strain is set to last until at least 2025, according to energy executives.

“Europe could have an even bigger problem next winter,” Niek Den Hollander, chief commercial officer at German energy giant Uniper SE, said in an interview at the Gastech conference in Milan this week. “It is possible that nations won’t be able to fill up storage sites next summer as much as we have managed to do this year.”

Europe is gripped by its worst energy crisis in 50 years as Russia slashes deliveries in retaliation for sanctions imposed over its invasion of Ukraine. With prices soaring, the squeeze has intensified a cost-of-living crisis and pushed economies to the brink of recession.

Europe’s leaders are dealing with the near-term pain and have earmarked more than 300 billion euros ($297 billion) to take the sting out of soaring energy costs this winter. But they face a reckoning when those measures expire and there’s still no relief.

“It’ll be somewhere between 2025 and 2027 that we’ll see the prices in Europe coming back to where they were at the beginning of 2021,” Ed Morse, global head of commodities research at Citigroup Inc., said in a Bloomberg TV interview. Capacity for exporting liquefied natural gas “doesn’t grow overnight.”

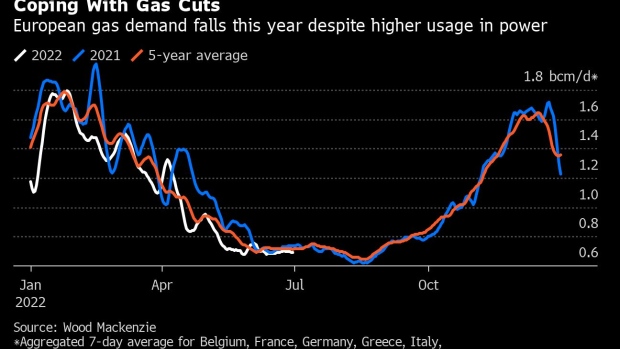

After decades building up its reliance on Moscow, the region now faces a painful reset, with strapped consumers forced to rein in usage and businesses cutting output.

“This is going to culminate in demand destruction,” said Charif Souki, chairman and co-founder of LNG developer Tellurian Inc. “People will have to change the way they live. You will drive your car less often, you will turn on your heating less often, you will turn on your lights less often, and you will have to live with industrial production that is curtailed.”

The key problem is that Russian gas -- which last year covered about 40% of European Union demand -- can’t easily be replaced. After Gazprom PJSC cut flows through the Nord Stream pipeline indefinitely over the weekend, supplies via Ukraine could be next.

“If the Kremlin’s end game is to completely starve central Europe of Russian gas supplies, then certainly transit via Ukraine is at risk,” said Laura Page, a senior LNG analyst at energy-data company Kpler.

The EU aims to discuss a price cap on Russian gas imports, part of an unprecedented plan to step into energy markets. President Vladimir Putin has already warned that Moscow won’t supply anything if the cap is introduced.

The standoff puts pressure on Europe’s leaders to diversify sources. Norway is now the main provider of Europe’s gas, but it doesn’t have capacity to fully offset supplies from Russia. Other nearby suppliers such as Azerbaijan and Algeria face some similar bottlenecks.

LNG, which can be carried by ship from far-away producers such as the US and Qatar, is a promising option. Germany -- among the countries most exposed to the loss of Russian deliveries -- is pushing to open its first floating LNG terminals in the coming months.

But import capacity is only one side of the problem. Global LNG production is already tight and increasing capacity takes as least three years, according to Colin Parfitt, vice president at Chevron Corp. Meanwhile, Europe has to fight with Asia for the existing volumes for the next couple of years.

With Europe facing a smaller pool of gas available, markets will remain tight for the foreseeable future.

“We will get back to a more normal situation, but it will take time,” Helge Haugane, senior vice president at Norwegian energy company Equinor ASA. “Volatility in prices is here to stay for longer.”

©2022 Bloomberg L.P.