Sep 9, 2022

Europe’s Challenge to Survive Without Russian Gas in Five Charts

, Bloomberg News

(Bloomberg) -- European governments are drafting drastic measures to cut energy demand and survive the winter without natural gas from Russia. That’s going to be a huge challenge.

Gas prices have eased from record levels, but remain at eye-watering levels, and the toll of industrial shutdowns is lengthening. A key meeting of European Union energy ministers on Friday aims to ease the impact of the worst energy crisis in decades.

Russia has already slashed gas exports to Europe to the bare minimum in retaliation for international sanctions over its invasion of Ukraine, and the recent move to halt crucial Nord Stream pipeline flows to Germany has ramped up the pressure on the bloc.

Even assuming the region succeeds in curbing gas consumption by a targeted 15%, there’s still a big question mark over whether alternative power sources including hydro and nuclear could fill the gap left by Russian cuts. It’s also unclear whether shipments of liquefied natural gas -- a key alternative to Russian supplies -- will remain plentiful.

“High prices, and resulting demand destruction, may ultimately mean that Europe will avoid running out of gas,” Catriona Lindsay, senior pricing analyst at DB Group Europe, said in a note. “The cost will be nevertheless astronomical.”

Read More: Germany, Austria Against Price Cap on Russian Gas: Energy Update

Here is a closer look at five things to watch, which will decide whether Europe can cope in the coming colder months.

Keep It Tight

If the 15% cut is achieved, and the weather is favorable, there is a chance the continent can cope during this heating season, even if there is a complete cutoff of Russian gas, according to Fitch Ratings. But the supply-demand balance is challenging for economic powerhouse Germany, with its gas stockpiles expected to shrink, meaning there will be almost no buffer against surprises including abnormal cold. “The margin for error will tighten,” said Angelina Valavina, head of EMEA natural resources and commodities at Fitch.

Germany’s storage sites are almost 87% full but Russia’s gas cuts seriously threaten its target to have 95% by the start of November. Even that level would cover only 2 1/2 months of demand with Russian flows at zero, Klaus Mueller, president of the Federal Network Agency energy regulator, warned last month.

Read More: European Gas-Price Lull Masks Looming Supply, Demand Uncertainty: BI

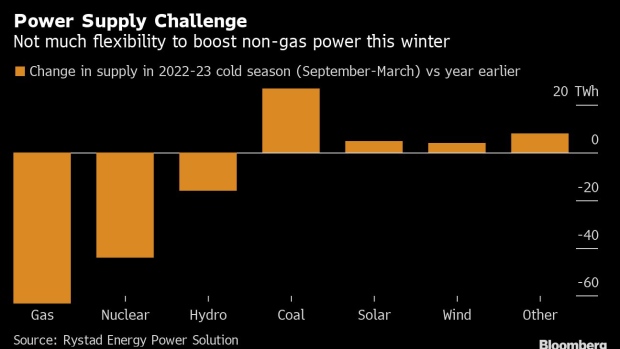

Power Challenge

While industries have cut gas consumption, demand for the fuel in power generation has been higher than expected. Heat waves and droughts crippled hydro capacities this summer, while warmer river waters and French nuclear outages curbed atomic power. The generation balance in Europe is “severely challenged” because there is “not much flexibility to ramp up considerably from other sources,” analysts at Rystad Energy said in a note. Very cold weather and low wind could lead to power rationing and blackouts, they said.

Read More: Europe Ramps Up Coal Burn to Fight Gas Crunch

Competition With Asia

China’s Covid Zero policy, combined with elevated spot prices, have reduced the Asian nation’s LNG imports by about 20% so far this year, leaving ample supplies for Europe. BloombergNEF expects China -- the world’s top LNG buyer last year -- to partially restore purchases through December, but still keep volumes below 2021 levels. Still, a sudden increase in Asian demand would stoke the global supply crunch.

Read also: New Gas Terminals Arrive to Ease Putin’s Grip on European Energy

Unplanned Outages

Another big risk is unplanned outages, especially an event at a large-scale facility like the Freeport LNG plant in the US, which was damaged by a fire in June. The incident noticeably reduced total exports from the country; that was manageable for Europe this summer amid muted demand from China, but potentially very damaging in winter. The facility plans to restart in early to mid-November, but traders fear that the outage may be extended.

Weather Factor

Weather is the most unpredictable factor. Last winter was relatively mild, leaving Europe with higher-than-expected fuel stockpiles. And forecasts for October, when the heating season kicks off, show temperatures above normal. But should Europe ultimately face something similar to 2012, which was the coldest winter in the last 10 years, then the region’s gas demand will be about 20 billion cubic meters -- or 5% of the usual annual consumption -- above current assumptions, according to Fitch’s Valavina. That would mean “a more challenging supply-demand balance for 2023” she said.

Read More: Europe’s Winter Gas Shortages Set to Last at Least Until 2025

©2022 Bloomberg L.P.