Apr 3, 2023

Europe’s Inflation Crisis Pulls Governments Into a Food Fight

, Bloomberg News

(Bloomberg) -- Tax cuts, price caps, tougher scrutiny. Europe’s battle with the worst cost-of-living crisis in a generation is far from over, and food is the latest focal point.

Even as headline inflation starts to ease, the upward pressure on food prices remains firmly in place. That means a large chunk of household spending, the weekly supermarket trip, is rapidly getting more and more expensive. To take just one example, sugar, used in a myriad of products, surged to the highest in more than a decade last week.

For governments, there’s an urgency to act given how the inflation squeeze has already left many families struggling to make ends meet, sparking strikes and protests across Europe as workers seek bigger pay demands.

Even pricier food risks further aggravating social discontent and frustration with authorities. On top of that, an surprise oil output cut by OPEC+ at the weekend is pushing oil prices higher, threatening to spur domestic energy costs and inflation.

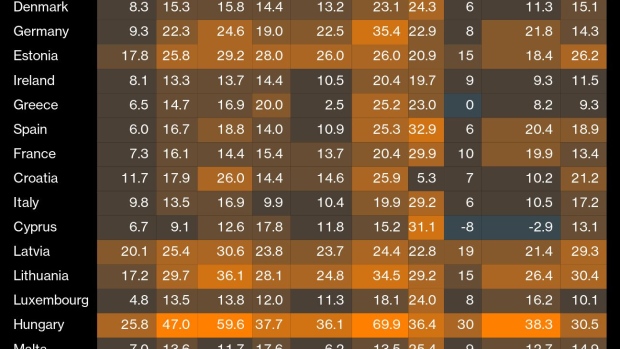

In some parts of the eurozone, food prices are rising at a pace not seen in postwar history, according to Rabobank Group senior economist Maartje Wijffelaars. Data last week showed euro-area inflation eased to 6.9% in March. In France, it slowed to 6.6%. But food-price gains accelerated to about 16%. It’s a similar story in Germany, where food inflation is above 20%.

That’s prompting more European governments to step up measures to stem the pace of increases, policies typically pursued by lower-income countries. Portugal scrapped taxes on essential items, while France has pushed supermarkets to take a hit on margins and Sweden stepped up scrutiny of grocers.

“You don’t think it will happen in a place like Europe, but with food prices going 15-20%, for some food items even more, governments are getting increasingly nervous,” said Angel Talavera, head of European economics at Oxford Economics. “Food inflation is really damaging and especially with elections coming, it gets people really angry.”

Tackling food inflation is more complicated than interventions in more regulated energy markets. Multiple factors have been driving prices higher, from droughts and trade-flow disruptions to fertilizer costs and diseases like bird flu. On top of that, higher energy and labor costs are squeezing food producers and growers.

While the intervention so far is small compared with the sheer scale of the energy support, it still signals increasing anxiety.

Here are the main food-price targeting measures undertaken by European governments in recent months:

Tax Cuts

Portugal, where food prices are rising more than 20% year-on-year, will temporarily cut value-added tax to zero on a basket of essential foodstuffs. It’s the latest country to take such action after countries including Poland and Spain.

In Spain, the tax measures have covered staples such as bread and olive oil. But they haven’t been enough to stem the relentless rise in prices.

That’s putting pressure on Prime Minister Pedro Sanchez, who is facing elections by the end of the year, to do more. His junior coalition partner, the far-left Unidas Podemos party, has called for a food-price cap and a discount of 14% on 20 basic items.

Poland plans to keep its zero food tax in place through the first half of this year, and may extend it further. Italy’s government is looking into taxes on basics such as pasta, bread and milk.

Price Caps

Food price caps are an aggressive intervention that many governments aren’t keen to implement, and there’s always a risk they could backfire, if Hungary is any guide. It introduced caps in early 2022, but food-price inflation has since accelerated to almost 50%.

The cap meant retailers had to sell certain goods at a loss, but to compensate they increased prices on other products. In a throwback to the nation’s communist past, retailers rationed staple foods such as potatoes in the runup to Christmas, creating shortages for consumers.

Hungarian Prime Minister Viktor Orban said last week the steps have helped with inflation, but acknowledged that they “roil supplies since they are an artificial intervention.”

The International Monetary Fund last month criticized measures that damp the pass through of price increases as “suboptimal” because they are expensive and benefit even those that don’t really need it. Targeted cash transfers are the “most cost-effective way of alleviating the burden on vulnerable households,” its economists said in a working paper.

Retail Pressure

For many governments, the challenge is figuring out how to protect consumers without distorting markets.

In France, where soaring food costs helped push inflation to a euro-era record in February, President Emmanuel Macron is under additional pressure from mass protests against pension reforms.

His government has negotiated a deal with supermarkets that allows them to showcase bargains with an official sticker in the colors of the national flag on cut-price essential items. It estimates that companies will take a margin hit amounting to several hundred million euros over three months.

Portugal’s Socialist government is also working with retailers and food producers to try to bring down prices. Modelo Continente, the country’s biggest supermarket chain, said it’s willing to accept lower profit margins to absorb some of the increases that have forced customers to cut back on spending.

Tougher Oversight

With consumers getting squeezed and many businesses enjoying healthy profits, there are accusations that the inflation pain is all falling on shoppers.

Supermarket chains in Portugal have been the target of price inspections, and Spain has started monthly meetings with stores, transportation firms and food growers to make sure tax cuts translate to lower prices for consumers.

In Sweden, grocers have faced increased scrutiny after data showed that food prices are rising at the fastest pace since the early 1950s. That prompted calls for price caps, and the three largest food retailers were summoned by the country’s finance minister.

With almost 90% of the Swedish grocery sector dominated by just three retailers, the government will boost funding of the nation’s competition watchdog.

Norway is making similar moves, and said its watchdog will be given “greater muscle” to intervene “earlier and more widely where they see competition problems.”

--With assistance from Jeremy Diamond, Rodrigo Orihuela, Ott Ummelas, Jonas Ekblom, Thomas Hall, Henrique Almeida, Joao Lima, William Horobin, Niclas Rolander, Piotr Skolimowski, Alonso Soto and Zoltan Simon.

(Updates with OPEC+ output cut in fourth paragraph)

©2023 Bloomberg L.P.