Oct 11, 2022

Europe’s Russia Oil Sanctions Are Affecting Trading Already

, Bloomberg News

(Bloomberg) -- European Union sanctions on Russian oil might still be eight weeks away, but they’re hitting trade in the nation’s crude already.

The bloc’s measures, including a ban on insuring tanker shipments, enter into force on Dec. 5. A Russian cargo still on the water after that date will no longer be covered by a European underwriter or reinsurer.

But because of the time-lag between purchasing a cargo, loading it on a tanker, and getting it to its destination, some trade flows will fall foul of Europe’s measures -- as the bloc’s legislation currently stands.

The US has long voiced concern that Europe’s plans will choke off Russian supply and drive up oil and fuel prices because insurance is an integral part of trading and European firms are so important within that. The US Treasury has pressed the EU to keep key services available to traders who are willing to pay a capped price for Russian petroleum.

Not Set

But the amendment to the EU’s rules isn’t set in stone yet, meaning as legislation stands if a price cap is not agreed in time, some trades will fall foul of European sanctions by the time cargoes reach their destinations.

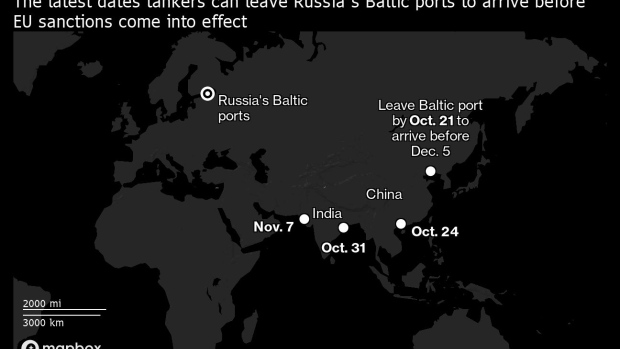

The average voyage time for a ship traveling from Russia’s Baltic Sea to eastern China is about 45 days, according to vessel tracking data monitored by Bloomberg.

To beat the Dec. 5 deadline, a tanker would need to leave the Baltic by Oct. 21 to reach eastern China, moor and discharge its cargo. That assumes that it experiences no delays passing through the Suez Canal and doesn’t have to wait off the discharge terminal before unloading.

However, traders say that anyone purchasing Urals crude today for loading from the Baltic will likely collect their cargo in late October.

That means buyers hoping to ship such cargoes to eastern China would have to accept an alternative to traditional insurance -- at least for part of the voyage, including arrival at port.

Moving West

With each day that passes, the line marking the furthest distance that Russia’s crude can be shipped before EU sanctions come into effect shifts west.

By Oct. 24, it will no longer be possible to reach ports in southern China. A week later and the east coast of India will be out of range, with the ports of Mundra, Sikka and Vadinar on the west coast of India unreachable after Nov. 7.

Life could get even more difficult if the EU’s ban on the use of the bloc’s tankers to haul Russian crude, adopted under the eighth sanctions package, is ratified. Such a move could limit the number of tankers available to complete the trade -- unless traders buy Russian oil under the price cap, allowing them to access the giant Greek fleet.

Europe is home to a swath of insurance mutuals who form part of the International Group of P&I Clubs, which is based in London.

IG members cover 95% of the world’s tanker fleet against risks including oil spills. It purchases reinsurance that is often provided by European firms.

©2022 Bloomberg L.P.