Mar 27, 2024

European Stocks Cling to Fresh Record Highs as H&M Boosts Retail

, Bloomberg News

(Bloomberg) -- European stocks clung to Tuesday’s record high as Sweden’s Riksbank laid the groundwork for a rate cut as soon as May and fresh data showed eurozone economic confidence improving.

The Stoxx Europe 600 edged 0.1% higher at the close in London, with gains for Hennes & Mauritz AB boosting the retail sector and energy stocks lagging. Travel and leisure pulled lower as Flutter Entertainment Plc was hit by a report about a possible prop bet ban on college basketball athletes in the US.

The wider benchmark is heading to a 10th straight week of gains, the longest winning streak since 2012.

H&M jumped after operating profit beat estimates as the Swedish fast-fashion company cut costs and introduced new spring looks. Among other single stocks, Banca Monte dei Paschi di Siena fell after Italy sold about €650 million worth of shares as part of the government’s plan to divest from the bailed-out lender. DS Smith Plc rose after saying it’s in talks for a possible all-share offer from International Paper Co., setting the stage for a bidding war with Mondi Plc.

Sweden’s central bank kept its benchmark interest rate at 4% as expected, but policymakers strengthened signals on a cut within the next quarter. On the macroeconomic front, a sentiment indicator published by the European Commission rose a little more than expected, amid signs the continent is bottoming out.

“We’re now in a trend where growth and manufacturing are picking up and central banks are converging towards monetary easing,” said Francois Rimeu, a strategist at La Francaise Asset Management in Paris who remains broadly optimistic for equity markets.

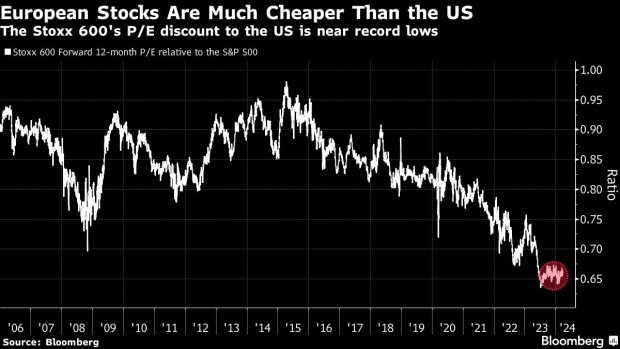

Lower valuations for European stocks compared with US peers have also driven capital flows toward the continent, with the Stoxx 600 set to outperform the S&P 500 in March.

“European stocks are enjoying a nice cocktail,” said Alexandre Hezez, chief investment officer at Group Richelieu, a Paris-based asset manager. With sentiment warming up to European stocks, he added that foreign investors might start returning to the continent even more into the second quarter.

For more on equity markets:

- Stars Are Aligning for an Energy Sector Catch-Up: Taking Stock

- M&A Watch Europe: DS Smith, Mondi, IP, Paschi, NatWest, Diploma

- Additional Offerings Rebound as European Stocks Rally: ECM Watch

- US Stock Futures Rise; nCino, Trump Media & Technology Gain

- Middle England Loves a Bargain: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Sagarika Jaisinghani and Allegra Catelli.

(Updates with closing details. A previous version of the story was corrected to replace a chart that had an erroneous sub-head.)

©2024 Bloomberg L.P.