Mar 20, 2024

European Stocks Drop as Luxury Sees $30 Billion Value Wipeout

, Bloomberg News

(Bloomberg) -- European stocks were muted ahead of a crucial Federal Reserve policy decision that will likely avoid signaling an imminent rate cut this week and keep the focus on elevated inflation.

The Stoxx 600 was closed largely unchanged. Luxury shares shed more than $30 billion in market capitalization in early trading after a sales warning from Gucci parent Kering SA, but had recovered about half their declines by the close. The consumer products and services sector, which includes luxury stocks such as LVMH, and Hermes International SCA, was still the biggest decliner among European sectors.

Energy stocks also lagged, while utilities outperformed.

The luxury sector “is beginning to reveal fractures, particularly evident in the case of Kering. The underlying factor behind these developments is the uncertain state of the Chinese consumer,” said Florian Ielpo, the head of macro research at Lombard Odier Asset Management.

Among other single stocks, Johnson Matthey Plc rose after agreeing to sell its medical device business and announcing a buyback program. Lonza Group AG gained after it agreed to buy a manufacturing facility in the US from Roche Holding AG.

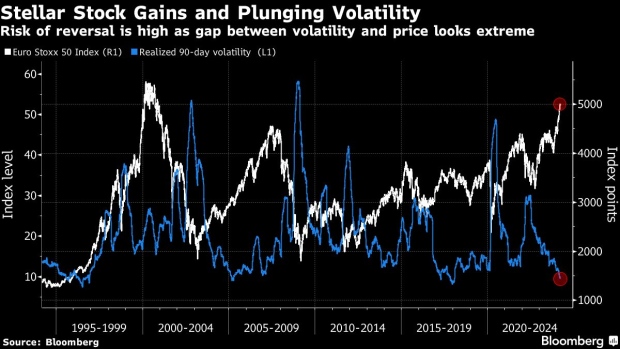

European stocks have sustained a strong rally for the past two months on resilient global growth and the prospect of rate cuts from central banks. They have also outperformed the S&P 500 in the past eight weeks. With market positioning at such bullish extremes, there’s a worry that any hawkish surprise from the Federal Reserve could unleash a wave of profit taking.

“There is a small chance that the Fed may push its first rate cut further into the future which could trigger more profit taking in stock markets,” said Joachim Klement, Liberum strategist.

Comments from Fed Chair Jerome Powell and the so-called dot plot that shows where officials anticipate rates moving will help investors gauge upcoming policy tweaks. Markets are pricing in three interest rate reductions in 2024, down from six at the start of the year. The US central bank will likely reiterate its focus on stubborn inflation while keeping one eye on a slowly rising jobless rate.

In the UK, inflation fell more sharply than expected to the lowest level in over two years, keeping the Bank of England on track to reduce interest rates later this year.

For more on equity markets:

- Everyone’s a Bull and It’s Becoming a Bigger Worry: Taking Stock

- M&A Watch Europe: Johnson Matthey, Lonza, Telecom Italia, Atos

- UK-Dutch Rivalry Is Back for Listing of Unilever Unit: ECM Watch

- US Stock Futures Unchanged; Danimer Scientific, Nasdaq Inc. Fall

- Unilever’s Frosty Farewell: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika and Sagarika Jaisinghani.

©2024 Bloomberg L.P.