Mar 7, 2024

European Stocks Ease From Record as Focus Turns to ECB Decision

, Bloomberg News

(Bloomberg) -- European shares extended gains, with the benchmark index setting fresh records beyond 500 points for the first time ever, after the European Central Bank’s softer inflation outlook bolstered expectations of interest-rate cuts.

The Stoxx 600 index was 1% higher at 503.4 points by the close in London. The gauge breached the key level for the first time earlier Thursday — 24 years after hitting 400 points.

The ECB left interest rates unchanged and revised its inflation outlook lower, feeding hopes that monetary easing may begin in June. European real estate and health care stocks outperformed, while Novo Nordisk A/S jumped to an all-time high after it presented data on its weight-loss drug amycretin.

“This announcement’s initial reaction is positive as the ECB sees itself as reaching target in two years’ time, somewhat declaring victory over inflation,” said Florian Ielpo, the head of macro research at Lombard Odier Asset Management.

The ECB deposit rate was left at 4% while the central bank’s latest quarterly outlook puts inflation at 2.3% this year — down from 2.7% in December — and revises the 2025 forecast down to 2%.

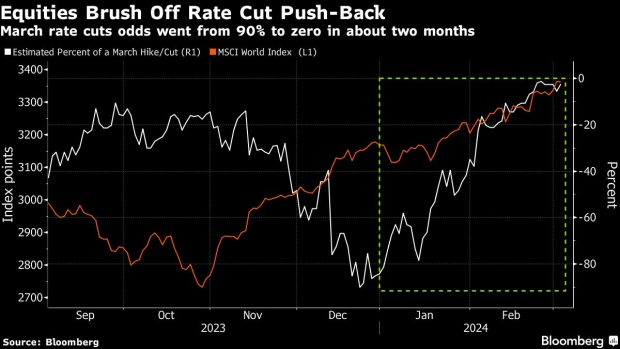

The main regional index has advanced for four consecutive months, with sentiment boosted by the frenzy around artificial intelligence. Equities have been unfazed by the repricing of rate-cut expectations for this year.

Lilia Peytavin, European portfolio strategist at Goldman Sachs Group Inc. in Paris, said the rally is “becoming more healthy with a wider breadth, notably across cyclical stocks.”

Indeed, the autos sector is the second best performer year-to-date followed by tech stocks.

“The narrative on the extreme concentration is switching to a broader rally,” Peytavin said. “The rally is ongoing despite rate cut expectations having been pushed further away to the summer and economic growth not accelerating.”

Among other big stock moves on Thursday, Virgin Money UK Plc soared as Nationwide Building Society said it has reached a preliminary agreement to buy the British lender for £2.9 billion ($3.7 billion). Hugo Boss AG slumped as much as 20% after the German retailer’s outlook fell short of analysts’ expectations.

For more on equity markets:

- Markets Seem Too Complacent About Interest Rates: Taking Stock

- M&A Watch Europe: Virgin Money, Nationwide, Encavis, Bayer

- Galderma Set to Bring Europe’s IPO Revival to Zurich: ECM Watch

- US Stock Futures Unchanged; OneSpan Inc, Honest Co. Gain

- Budget Day Is Here: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika, Julien Ponthus and Sagarika Jaisinghani.

©2024 Bloomberg L.P.