Nov 13, 2023

European Stocks Gain as Traders Look Ahead to US Inflation Data

, Bloomberg News

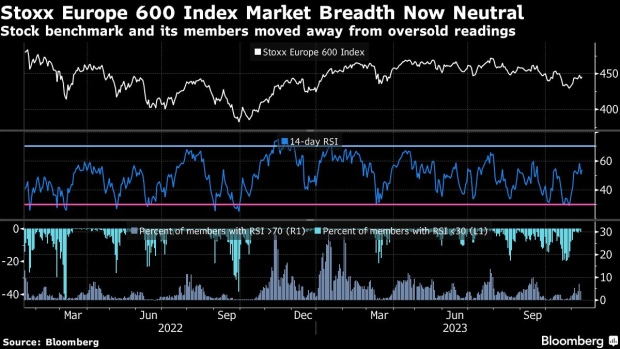

(Bloomberg) -- European stocks rose in a broad rally ahead of US inflation data on Tuesday, which will provide clues on the outlook for Federal Reserve interest rates.

The Stoxx 600 Index was up 0.8% higher at the close in London, with travel & leisure, energy and banks sectors leading the advance. Evolution AB led the surge in travel and leisure shares after the company’s chief executive officer bought shares. Oil rose after three weeks of decline and gave a boost to energy stocks.

All eyes will be on US inflation numbers this week as the economy shows continued resilience, which has strengthened the odds that the central bank will be able to steer the US into a rare soft landing. Sentiment remains at risk, however, should the reading on price pressures or central bankers’ commentary point to a higher-for-longer stance.

“It’s hard to squeeze much more from equities, given how much they are already pricing a disinflationary report,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management.

“Any bad news from the inflation report and equities will rapidly flux back to where they were a couple weeks ago,” Ielpo said. “This rally can have legs, but for that, we need confirmation that we still live in a soft-landing/disinflation world.”

Top banks Morgan Stanley and Goldman Sachs Group Inc. diverge on Fed rate cut forecasts, reflecting different narratives in the market. While Morgan Stanley economists forecast the Federal Reserve to make deep interest-rate cuts over the next two years as inflation cools, at Goldman Sachs, analysts expect fewer reductions and a later start.

In other individual stock moves, Novo Nordisk A/S rallied after data on weight-loss drug Wegovy showed it cut heart attacks in obesity patients with a history of cardiovascular disease, before the stock pared its gains. Siemens Energy AG jumped as investors anticipated an agreement on guarantees, due to be unveiled on Wednesday. Meanwhile, Richemont declined for a second day after its disappointing results were followed by a few price-target cuts.

On earnings, UBS Global Wealth Management strategists said European companies may not have shown widespread weakness, but downgrades to their forecasts are the worrying factor. Goldman Sachs strategists, on the other hand, said investors are overly concerned about the weakening outlook for US corporate earnings, which so far merely track a historical pattern.

For more on equity markets:

- High Cost of Debt Is Emerging as Top Risk for 2024: Taking Stock

- M&A Watch Europe: TotalEnergies, Vodafone, Cellnex, SocGen

- US Stock Futures Fall

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Jan-Patrick Barnert.

©2023 Bloomberg L.P.