Oct 20, 2022

Fed Swaps Price In 5% Peak for Policy Rate in First Half of 2023

, Bloomberg News

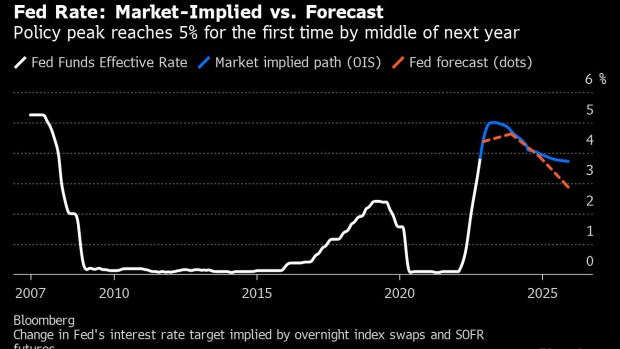

(Bloomberg) -- The market for wagers on the Federal Reserve’s policy rate priced in a peak of 5%, the highest yet, for the first half of 2023.

The rates on the March and May 2023 overnight index swap contracts held above 5%, near their session highs of 5.02% and 5.03% respectively, in late New York trading hours. They were below 4.70% as recently as Oct. 13, before a report showing that US consumer prices rose in September more than estimated.

“This is a kind of milestone,” former US Treasury Secretary Lawrence Summers said on Twitter. The market-implied terminal rate is “more likely than not to rise more,” although its 400-basis-point climb over 18 months “is surely most of the increase we will see in this cycle.”

The rise in expectations of a higher peak policy rate was accompanied by Treasury yields across the curve rising to fresh multiyear highs, with the policy sensitive two-year rate up 5.5 basis points at 4.61% late in New York. The 10-year yield was higher by nine basis points at 4.225%, on track for a twelfth straight weekly increase, matching a run previously recorded in 1984. Treasury yields have risen steadily over the past month as rate hike expectations for the current Fed cycle have intensified, with the two-year climbing from 4% and the 10-year up from around 3.5%.

The Fed has raised its policy rate five times since March, most recently to a range of 3%-3.25% in September, after dropping the lower bound to 0% in 2020 at the onset of the pandemic.

A fourth three-quarter-point increase was priced into the contract corresponding to the next meeting on Nov. 2 after the September inflation data, and another move of that size is almost fully priced in for the year’s final meeting in December.

The policy rate was last raised to 5% in 2006.

(Adds Summers comment, updates rate levels.)

©2022 Bloomberg L.P.