Mar 31, 2023

Fidelity Buys Europe AT1s After Credit Suisse Leaves Opportunity

, Bloomberg News

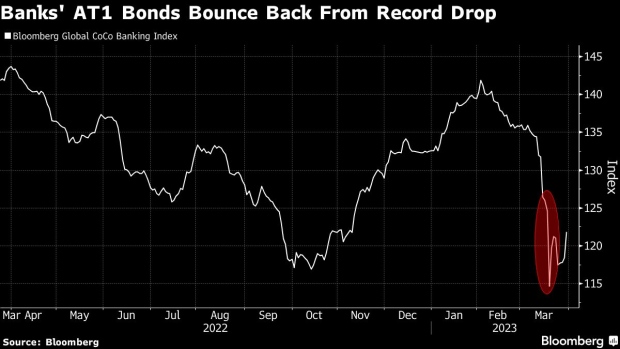

(Bloomberg) -- Fidelity International favors contingent convertible bonds sold by European banks after Credit Suisse Group AG’s collapse spurred a stampede out of the $250 billion plus market.

CoCos, also known as additional tier 1 securities, suffered “indiscriminate” selling after the debt issued by Credit Suisse was written down following the terms of its government-led rescue, according George Efstathopoulos, a money manager in Singapore. That presented an opportunity to buy beaten-up notes from issuers governed by jurisdictions outside of Switzerland, he said.

There was a “sell now, ask questions later” approach to trading AT1s in the thick of the crisis and that allowed the fund “to actually buy a bit,” said Efstathopoulos. “This is an area where fundamentals look very, very strong. Profitability has been decent.”

Banking Chaos Creates ‘Once-in-a-Decade’ Bond Buying Opportunity

Fidelity joins BlueBay Asset Management in betting on CoCos, when other investors had fled the market on fears of similar write-downs, while concerns mount that banks will break the convention of buying back the debt in the coming months. An index of contingent convertible bonds issued by European banks had a yield of 12%, when they were as low as 7.8% in February.

Fidelity has ratcheted up its exposure of corporate hybrids, which include CoCos, to about 8.3% this month in its Global Multi Asset Income Fund from 6.3% last February, Efstathopoulos said. “We bought about 1% in March this year,” he said, adding “we could go more” in allocating to the sector.

Here are edited comments from a Q&A with Efstathopoulos:

AT1 Bonds

We’ve seen some pretty decent repricing, and I probably am more focused on European bank debt, moving outside of Switzerland, given it is a different jurisdiction with different regulations. The incidents in Switzerland were a bit more idiosyncratic in nature.

Treasuries Trading

The trading range is probably shifting downward for US 10-year Treasuries. It would have been sort of 3.5% to 4%, now call it 3.3% to 3.8%. At this stage we’re not buying heavily, but if we were to see another 20-30 basis points increase from here — whether it was the 10s or the 30s — we’d definitely be buying.

Emerging Markets

We like broad emerging market local currency. You’ve got an environment now where they’ve got steeper curves, improving real yields and better fundamentals overall. They’re in a much better place.

Cash View

Cash has been more of a king in the past year and a half because some defensive assets have not behaved as defensive assets. They’re still important to have in one’s toolkit for defensiveness, but increasingly there are other parts of capital markets and financial assets that are perhaps becoming a bit more interesting where you can get paid a pretty decent yield.

Recession Bets

What’s happened in the past two weeks probably means one key thing: lending standards are going to get tighter and tighter. And that only means that it is going to push the economy more toward a recession. Corporate retrenchment is already happening now.

©2023 Bloomberg L.P.