Dec 18, 2017

First Quantum buys right for 50% stake in Northern Dynasty project

Reuters

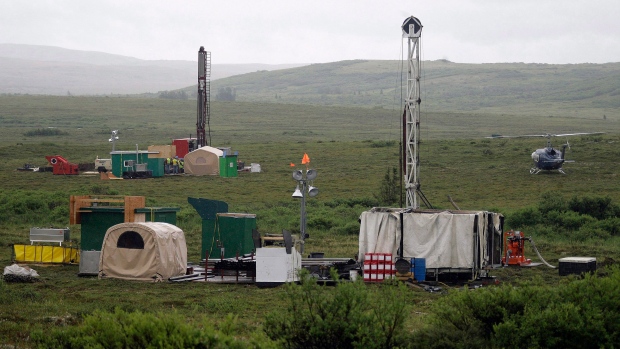

Northern Dynasty Minerals (NDM.TO) said on Monday it had found a potential partner to help develop its Pebble mine in Alaska, breathing new life into the world's biggest undeveloped gold and copper project in the face of strong opposition from environmentalists.

Northern Dynasty, a small Canadian mine developer, said First Quantum Minerals (FM.TO), the world's eighth-biggest copper producer, had agreed to acquire an option to buy a 50 percent stake in the project for $1.50 billion.

U.S.-listed shares of Northern Dynasty, which have surged 42 per cent in the past six months, fell 8 per cent to US$1.97. Shares of Vancouver-based First Quantum, which is developing a large copper mine in Panama, were 1 per cent firmer at $17.32.

The agreement gives First Quantum "a relatively inexpensive and low-risk option on a large copper/gold deposit without significant capital requirements until well into the next decade," Raymond James analyst Farooq Hamed said in a note to clients.

Northern Dynasty has been looking for a development partner for the project since Anglo American Plc, which spent more than US$500 million on it, pulled out in 2013 as gold and copper prices fell.

Copper prices are up nearly 25 per cent this year, while gold is up more than 9 per cent.

'VARIOUS HURDLES'

The development of the Pebble project into a mine is controversial as it is located in Alaska's Bristol Bay region, which is the world's largest sockeye salmon fishery. That has raised opposition from environmentalists, some native groups and sport fishermen.

"We are fully aware of the various hurdles facing this project ...," First Quantum Chairman and Chief Executive Philip Pascall said on a conference call.

In February 2014, the U.S. Environmental Protection Agency (EPA) took the unusual action of blocking the project even before the owner applied for a development permit.

In May of this year, the EPA, now led by Trump administration appointee Scott Pruitt, agreed to settle current lawsuits and other issues over the project, opening the path to permitting.

The project would make a permit filing to state and federal regulators in the coming days, Pascall said.

Under the agreement, First Quantum will make an option payment of US$150 million over four years, giving it the right to buy half of the Pebble project for US$1.35 billion.

Northern Dynasty in October unveiled new development plans for the project that will reduce the footprint of its major mine facilities such as the mine pit and waste storage area, hoping to make it more palatable to regulators.

Opponents remain unconvinced.

"The widespread and diverse opposition to the Pebble Mine should not be underestimated," Nelli Williams, Alaska Director for fishing conservation group Trout Unlimited, said in an email on Monday.

"Investors in this project will continue to have a long, difficult and costly road ahead of them," she said.