Jan 6, 2020

First Quantum fortifies its takeover defences with poison pill

, Bloomberg News

Jon Vialoux discusses First Quantum

First Quantum Minerals Ltd. is battening down the hatches in its latest move to defend itself against potential takeovers.

The Vancouver-based miner said Monday it has adopted a shareholder rights plan that would allow current investors to buy additional shares at a “substantial” discount should any party acquire 20 per cent or more of the company’s stock.

“The rights plan has been adopted with a view to ensure, to the extent possible, that all shareholders of the company are treated fairly in connection with any takeover bid,” First Quantum said in a statement.

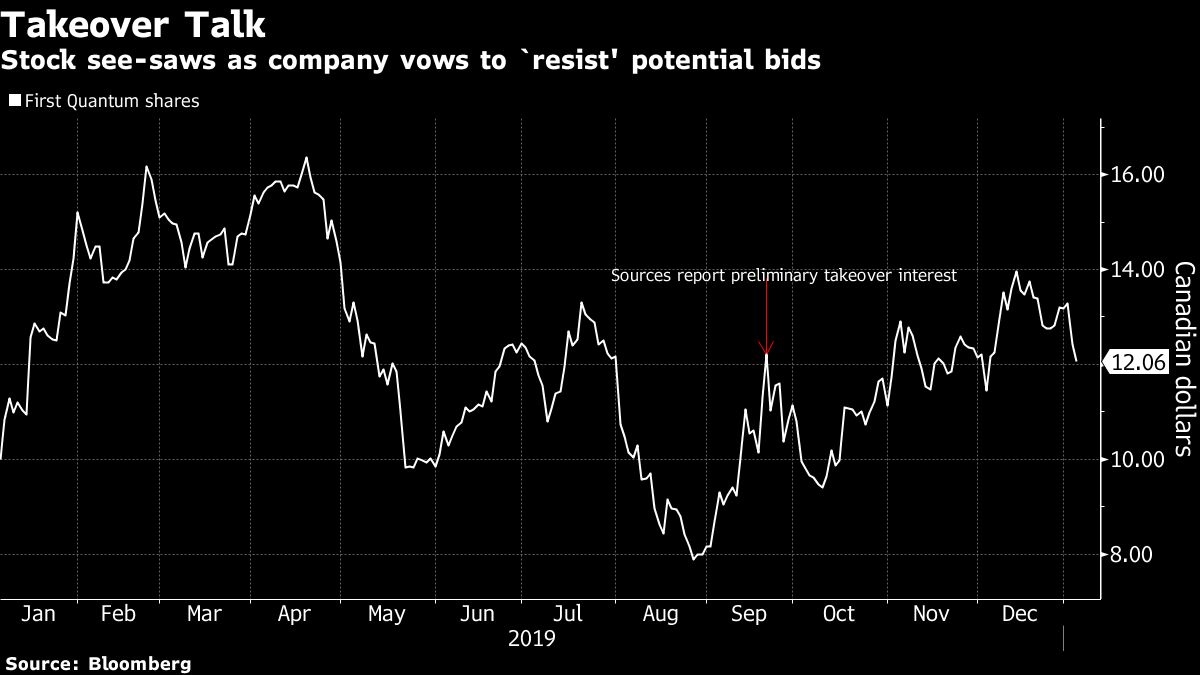

In an interview last month, President Clive Newall said the company was caught off guard by Jiangxi Copper Co.’s move to acquire an 18-per-cent stake in the company. In September, shares of the company surged after people with knowledge of the matter said the miner was drawing preliminary takeover interest.

In the December interview, Newall said the company hadn’t received any takeover approaches since it last refuted “speculation” it had been in talks about a bid in September. But he also said measures had been put in place to defend against any such move by Jiangxi. Under a non-disclosure agreement, the Chinese company is restricted from buying more than 20 per cent of First Quantum’s shares, he said.

If a takeover play was launched, First Quantum’s first reaction would be to “resist,” Newall said in the interview. “There’s no great desire to be taken over, but under the circumstances where you haven’t got much choice, then it’s all about price,” he added.

The company will ask shareholders to ratify the shareholder rights plan at its annual meeting in the spring, it said. The miner also adopted an advance notice policy that outlines the process should a shareholder wish to nominate persons to the board of directors.

First Quantum fell four per cent to $11.93 at 9:45 a.m. in Toronto. The shares rose 19 per cent last year.