Jun 28, 2021

Foley-Backed SPAC Reaches Merger Deal With System1 Marketing Firm

, Bloomberg News

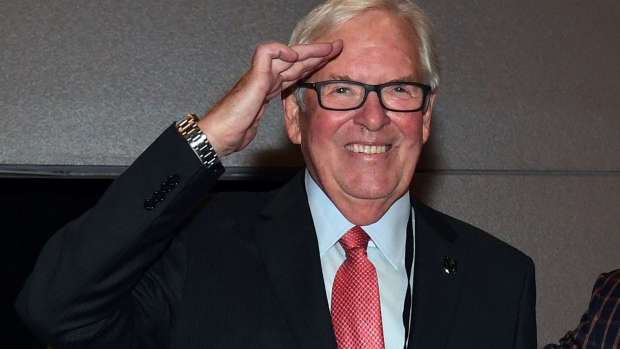

(Bloomberg) -- Marketing firm System1 has agreed to go public through a merger with a blank-check firm backed by Bill Foley in a deal that will give the combined company an enterprise value of $1.4 billion, according to people familiar with the matter.

The transaction with Foley’s Trebia Acquisition Corp. will provide about $175 million to fund the new company’s growth and acquisitions, said the people, who asked not to be identified because the information wasn’t public.

The transaction includes up to $600 million in financing, consisting of a $200 million equity backstop from Foley’s Cannae Holdings Inc. as well as debt, the people said. Concurrent with the transaction, System1 is combining with Protected.net, which develops security and privacy subscription products, they said.

System1 co-founder, Chief Executive Officer and Chairman Michael Blend will continue in his current roles, with Foley and Trebia Chairman Frank Martire joining the company’s board, the people said.

Trebia is one of several special purpose acquisition companies launched by Foley, who has risen to the top tier of backers during the SPAC surge of the past year.

Trebia, named after a historic European battle like some other Foley-backed SPACs, raised $517.5 million including so-called greenshoe shares in an initial public offering in June 2020. The largest of Foley’s SPACs, Foley Trasimene Acquisition Corp. II, raised $1.47 billion in August.

Founded in 2013, System1 is based in Venice, California and describes itself as an omnichannel customer acquisition platform. The company’s brands include Startpage, info.com and MapQuest, according to its website.

©2021 Bloomberg L.P.