Aug 10, 2020

Foot Locker jumps after quarterly sales rise despite retail woes

, Bloomberg News

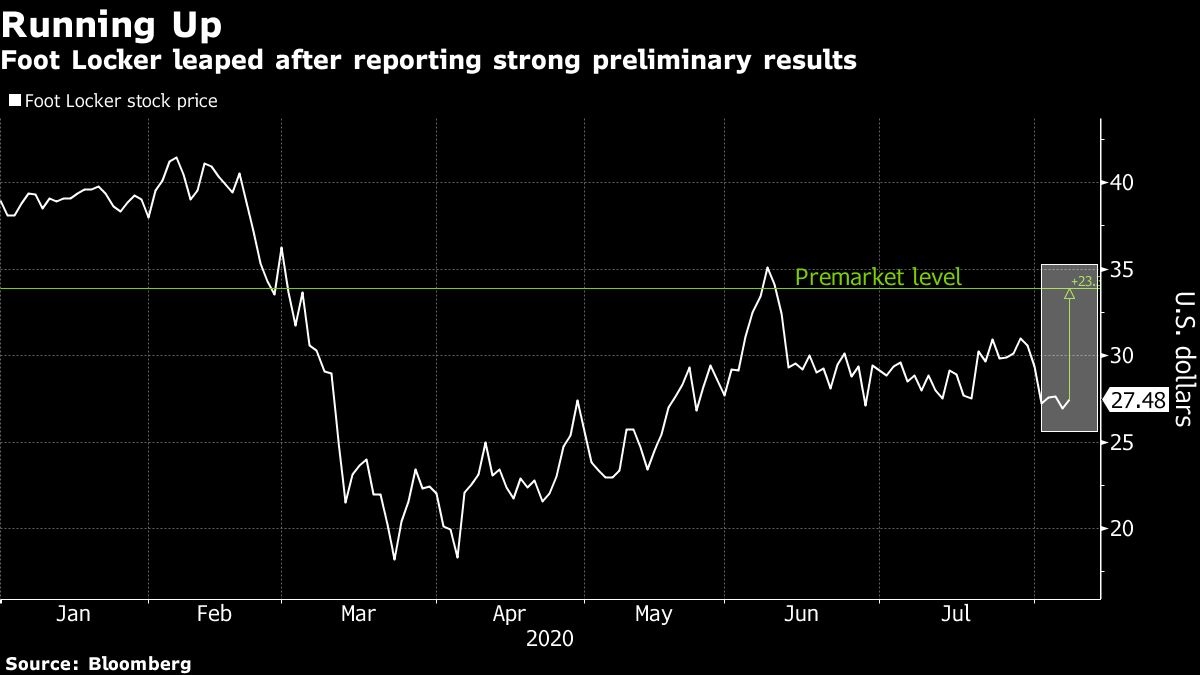

Foot Locker Inc. soared after the athletic-apparel retailer said it expects to report a profit and rising revenue for the second quarter, defying Wall Street’s expectations amid a tumultuous time for the clothing industry.

Same-store sales increased about 18 per cent for the three months ended Aug. 1, the New York-based company said Monday in a statement discussing preliminary results for the quarter.

Diluted earnings will likely be 38 cents to 42 cents a share. Analysts had expected an adjusted loss of 61 cents a share, according to the average of estimates compiled by Bloomberg, along with a decline in total revenue.

Foot Locker jumped as much as 9.6 per cent in New York trading Monday. The shares had fallen 30 per cent this year through Friday.

The performance was “aided by pent-up demand and the effect of fiscal stimulus,” Chief Executive Officer Richard Johnson said in the statement. “While these undoubtedly remain challenging times, we are nonetheless pleased by the health of our category, our deep connections with our customers and the strength of our vendor relationships.”

The results offer a glimmer of hope as mall-based apparel and footwear retailers struggle with falling demand, a trend that has accelerated amid the coronavirus pandemic.

Foot Locker, which withdrew its forecast in March and temporarily shuttered stores during the outbreak, has warned that the disruptions to organized sports and the back-to-school shopping season are likely to weigh on its performance.

The second-quarter results include about US$18 million in costs “in connection with the recent social unrest,” the company said without providing details. Demonstrations, most of which were peaceful, gripped the U.S. in May following the killing of George Floyd by police in Minneapolis. Some were accompanied by looting, causing damage to property.

Foot Locker’s upbeat report lifted athletic-goods makers, with Nike Inc. up as much as 4.3 per cent and on pace for an all-time high. Under Armour Inc. rose as much as 3 per cent, and Adidas AG gained as much as 3.1 per cent.

Foot Locker will report full quarterly results before markets open on Aug. 21.