Apr 10, 2024

French Deficit to Widen Even More, Raising Pressure on Macron

, Bloomberg News

(Bloomberg) -- The French government said its deficit will be wider than anticipated as pressure mounts on Emmanuel Macron to cut expenses — or find new sources of state income.

The finance ministry now sees a shortfall of 5.1% this year and 4.1% in 2025, compared to previous forecasts of 4.4% and 3.7%. It will then narrow to 3.6%, before hitting 2.9% in 2027, it said in an update to France’s multi-year public finance plan, which will be submitted to Brussels on April 17.

This comes after the government had already warned that the 2023 funding hole would be larger than expected, at 5.5% of GDP instead of 4.9%.

Budget talks are increasingly fraught with risks for Macron, who cannot run for a third consecutive term in 2027 and whose party is trailing Marine Le Pen’s by at least 10 percentage polls in European election polls.

Tensions had been flaring between the president, who wanted to avoid announcing further budget cuts before June’s EU ballot, and Finance Minister Bruno Le Maire, who’s advocated for more trimming, according to a person familiar with the relationship.

Le Maire appears to have prevailed, with his ministry saying on Wednesday that that a fresh round of €10 billion of savings is required this year.

That might prompt the conservative fraction Les Republicains to follow through on their thread of submitting a no-confidence vote in parliament, a move Le Pen’s party has said it would back.

Still, a motion seeking to topple the government would be risky for the Republicains, as Macron could respond by dissolving parliament, putting their seats in jeopardy. Le Pen’s National Rally is already the biggest opposition party in the lower house.

Meanwhile, the list of the Socialist member of European Parliament Raphael Glucksmann is rising in polls for EU election, suggesting that some disappointed Macron voters might be jumping ship, according to IFOP pollster Jean-Philippe Dubrulle.

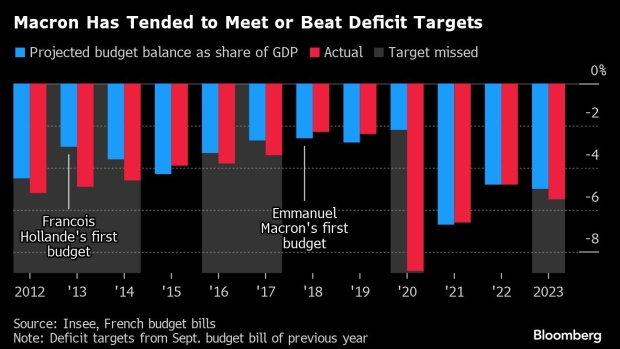

The latest update for deficit forecast raises doubts about Macron’s strategy of incrementally restoring finances through growth-enhancing reforms, such as relaxing labor laws or adjusting the retirement age. Prior to massive spending during the Covid and energy crises, this approach enabled him to sidestep harsh austerity measures and largely shield businesses and households from tax hikes.

While Macron already announced a new change in unemployment benefits, which could potentially alleviate the public budget, details aren’t known yet. Another way to cut spending, Le Maire has said, would be to ensure a stricter application of levies on the windfall profits of energy companies, which generated much less revenue than earmarked by the government last year.

Some key members of Macron’s coalition are publicly questioning his plan to reform unemployment benefits again, including the president of the National Assembly Yael Braun-Pivet and former transport minister Clement Beaune.

Earlier this year, the government already announced €10 billion ($10.8 billion) of savings for this year, and at least another €20 billion in the 2025 budget, citing slower-than-expected growth in Germany and China. The executive is also struggling to earmark funds to help Ukraine against Russia.

While the government has repeatedly ruled out tax increases, some lawmakers of Macron’s party have advocated for a one-off tax on the richest taxpayers.

France’s debt-to-GDP ratio will increase this year and peak at 113.1% in 2025, the new numbers from the finance ministry show. It will then retreat slightly in subsequent years.

Ratings firms have also take a more critical view of France’s finances, adding to the pressure. A year ago, Fitch Ratings downgraded France to AA- from AA, and S&P Global Ratings has a negative outlook on its assessment since December 2022.

--With assistance from William Horobin and Jenny Che.

(Updates with debt ratio in penultimate paragraph. An earlier version of this story corrected the headline)

©2024 Bloomberg L.P.