Aug 30, 2022

FTSE 100 Erases 2022 Gain With All European Indexes Now in the Red

, Bloomberg News

(Bloomberg) --

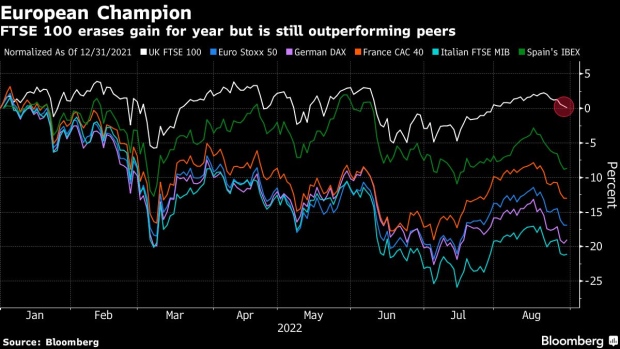

The FTSE 100 Index has lost its year-to-date advance, relinquishing the title of being the only major European stock index that was up for 2022.

Britain’s blue-chip benchmark fell as much as 0.6% on Tuesday, with commodity stocks hit by a 5% slump in crude oil futures. The UK was also catching up to broader losses in global markets, since trading was closed for a holiday on Monday.

The index had outperformed this year on surging commodity prices that boosted stocks such as Shell Plc and Glencore Plc. Rising bond yields had also previously made out-of-favor value stocks more attractive than growth sectors like technology, whose future earnings are discounted back at higher rates.

Europe’s Stoxx 600 has fallen 14% this year, compared with the FTSE 100, which is now flat.

That outperformance has narrowed in recent weeks. Investors have broadly sold out of equities and the UK’s weakening economy is also giving investors a reason to be wary.

Despite the recent losses, some are still holding to a view that the UK is a defensive play. Citigroup Inc. strategist Beata Manthey said last week that she prefers the index over continental peers. The FTSE 100 has several large consumer companies like Unilever Plc and Reckitt Benckiser Group Plc, whose earnings are less-affected by an economic slowdown.

“The UK is one place where you can find fairly cheap defensiveness at the moment,” she told Bloomberg Television.

©2022 Bloomberg L.P.