Nov 11, 2022

FTX Collapse Drags Crypto Stocks to $5 Billion Valuation Wipeout

, Bloomberg News

(Bloomberg) -- US stocks’ biggest rally in months wasn’t enough to ease the pain for holders of shares linked to the cryptocurrency space, some of which are headed for their steepest weekly losses in years amid FTX Group’s implosion.

Robinhood Markets Inc., MicroStrategy Inc. and Galaxy Digital Holdings Ltd. have each tumbled at least 15% this week, with Piper Sandler analysts calling FTX’s downfall a “clear setback” for the crypto industry.

Jitters persisted Friday as Sam Bankman-Fried’s FTX empire filed for Chapter 11 bankruptcy. That came less than 48 hours after a rescue bid from rival Binance Holdings Ltd. collapsed. Digital tokens including Bitcoin, the largest cryptocurrency, have spiraled lower as FTX’s fall marked the latest casualty from the nearly year-long crypto winter.

Robinhood is on track for its worst week since April as FTX’s bankruptcy removes any hopes that the crypto exchange could buy the trading platform amid questions surrounding Bankman-Fried’s 7.6% stake in the company. MicroStrategy, which has been purchasing Bitcoin in bulk since 2020, is on pace for the steepest decline in more than two decades, wiping out 37% in the past five days. Another stock in freefall is Silvergate Capital Corp., which is headed for a record 37% drop this week.

While a two-day rebound for some of the shares pared the declines, the week’s shocking developments have severely dented confidence in the risky industry. The losses have wiped out nearly $5 billion in value across a range of companies, data compiled by Bloomberg show.

The ugly stretch for crypto-exposed shares offered a stark contrast with the broader market, which is on track for the best week since June. The wider rally could only stem the losses for shares such as Coinbase Global Inc. and Hut 8 Mining Corp.

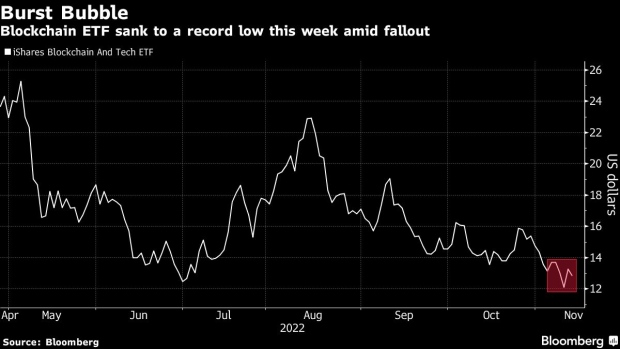

This year’s side in cryptocurrencies, highlighted by a roughly 75% slide for Bitcoin since its peak about a year ago, has wiped out trillions in value. That, along with a broader equity slide, has erased 46% of BlackRock’s iShares Blockchain and Tech ETF (IBLC) value since a debut in April.

©2022 Bloomberg L.P.