Nov 10, 2022

FTX’s Assets Frozen by Bahamas Securities Regulator

, Bloomberg News

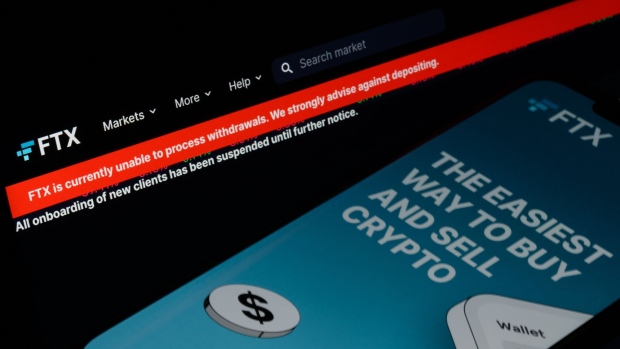

(Bloomberg) -- FTX.com had its assets frozen in the Bahamas, where the crypto exchange is based, as more signs emerged that mogul Sam Bankman-Fried’s empire is crumbling.

The decision to freeze FTX Digital Markets was “the prudent course of action” to preserve assets and stabilize the company, the Bahamas Securities Commission said in a statement Thursday. An attorney has been appointed provisional liquidator -- an initial step in assessing whether a company is sound or should be liquidated.

“Liquidation is what you in the States call bankruptcy,” said John K F Delaney, a commercial lawyer in the Bahamas. The provisional liquidator can be made permanent later if a so-called winding-up petition takes effect.

Bankman-Fried, the 30-year-old crypto wunderkind who spent a few turbulent months this summer propping up struggling rivals, saw his creation implode in a matter of days this week as it emerged that FTX had a multibillion-dollar balance sheet shortfall. He’s now trying to raise emergency financing to salvage the company.

The Bahamas’s move was the first by authorities to lock down parts of FTX amid widening signs of stress in Bankman-Fried’s digital-asset empire. In the US, employees at separate domestic exchange FTX US spent the day trying to raise money and were warned that they might not be paid much longer.

FTX said late Thursday that it had started to facilitate withdrawals of Bahamanian funds. “As such, you may have seen some withdrawals processed by FTX recently as we complied with the regulators,” FTX said on Twitter.

The mogul, meanwhile, announced that he’s shutting down Alameda Research, the trading house at the heart of his sprawling collection of businesses. Bankman-Fried is also being investigated by the US Securities and Exchange Commission for potential violations of securities rules, according to a person familiar with the matter.

“FTX US looks prepared to make payroll at least in the next cycle,” FTX US’s general counsel, Ryne Miller, wrote in an internal message to staff, a copy of which was confirmed by Bloomberg News. “Folks should prepare to make their own choices as appropriate for their personal situation on next steps.”

Miller said he’s not had much clear information from the founders and is trying to “preserve whatever is preservable of FTX US.”

Founder’s Assurances

Bankman-Fried said in a tweet Thursday that FTX US was “100% liquid” and “not financially impacted” by FTX International’s problems. FTX US’s trading may be halted in a few days and users should close down any positions, according to a notice from the website. Withdrawals will remain open, it said.

Miller’s message was sent to staff on a Slack channel and later deleted by a member of the founding team, according to a person familiar with the matter.

It’s been a wild week for FTX as Bankman-Fried -- once one of wealthiest and most widely followed voices in the world of digital assets -- struggled to patch a multibillion-dollar shortfall that triggered government probes and set off panic across crypto markets. An announcement that FTX.com had reached a deal to be acquired by a competitor proved short-lived, leaving the firm’s future in limbo.

Legions of traders expressed worry about losing their holdings in the debacle, with investors increasingly anxious over the blurred lines among Bankman-Fried’s business interests.

“The commission is aware of public statements suggesting that clients’ assets were mishandled, mismanaged and/or transferred to Alameda Research,” the Bahamas regulator wrote in its statement. “Based on the commission’s information, any such actions would have been contrary to normal governance, without client consent and potentially unlawful.”

The appointment of a liquidator is a way for the agency to take control of FTX, said Delaney, the commercial lawyer. The appointment requires a judge’s approval, and is essentially a means of displacing the business’s board of directors, he said in an interview.

FTX Digital Markets is the Bahamian subsidiary of FTX Trading, operating as FTX.com. The unit helps affiliates offer derivatives, options and other products and services to customers, according to a statement last year. The exchange is based in the Bahamas and is a separate legal entity from FTX US.

At FTX US, employees are in talks about selling parts of the business, including some assets that Bankman-Fried amassed on a sweeping acquisition tear across the industry, according to two people with direct knowledge of the matter, who requested anonymity because the talks were private.

Those employees, in some cases without Bankman-Fried’s participation, are pitching assets including stock-clearing platform Embed and naming rights to an arena in Miami, one of the people said.

FTX US on Thursday said that customers should close out any positions they want to and that trading may be halted in a few days.

For crypto market prices: CRYP; for top crypto news: TOP CRYPTO.

--With assistance from Jeremy Hill.

(Updates with US SEC probe in the fifth paragraph.)

©2022 Bloomberg L.P.