Nov 30, 2022

FX Traders Ready for Wild Christmas on Fed, China Uncertainty

, Bloomberg News

(Bloomberg) -- Currency traders hoping to enjoy a quiet run up to Christmas may be in for a shock.

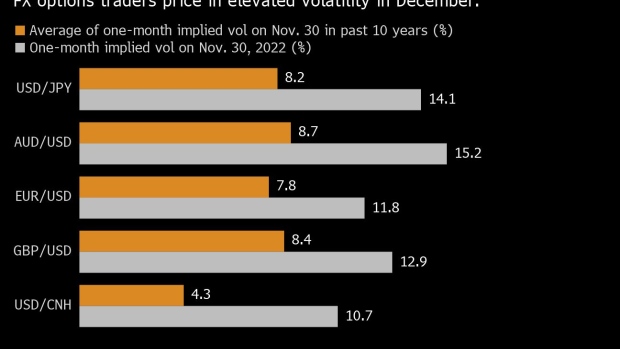

One-month implied volatility for major currency pairs -- a gauge of expectations for FX moves over that period -- are sitting well above their 10-year average for this time of year, according to data compiled by Bloomberg. That means options traders are bracing for another month of large swings in the currency market.

This year has already been a dramatic one in FX, as global rate hikes led by the Federal Reserve and twists and turns in China’s Covid journey whipsawed market sentiment. Twelve-month historical swings in the yen and euro hit the highest in at least five years against the dollar this month.

Investors won’t have long to wait for catalysts, with Fed Chair Jerome Powell due to speak Wednesday in Washington. Several key pieces of US data will also be out this week, including the Fed’s preferred measure of inflation and payrolls.

The currency market will see wild swings going into year-end, as it’s been late to catch up with higher volatility in equity and rates and many see the dollar at a turning point, according to Mitul Kotecha, head of emerging markets strategy at TD Securities in Singapore.

“Reduced liquidity and various risk factors, such as China Covid, Fed tightening and so on, all suggest that the scope for a decline in volatility is low,” he said.

©2022 Bloomberg L.P.