Nov 3, 2022

Germany’s Solo Trip to Beijing Exposes Europe’s Dilemma on China

, Bloomberg News

(Bloomberg) -- Chancellor Olaf Scholz will be bringing Germany’s biggest brands to China this week to underscore close economic ties, but he’ll also have to navigate growing concerns about Europe’s broader dependence on Beijing.

The powerhouse delegation — expected to include top executives from BASF SE, Volkswagen AG, Deutsche Bank AG and BioNTech SE — will showcase German success in the world’s second-largest economy. The one-day visit on Friday will also illustrate how much Berlin has to lose as calls grow in Washington, other European capitals and even within Scholz’s own coalition to change course.

After decades of viewing China primarily as a commercial opportunity, Europeans are reexamining the security risks of expanding ties with a country whose leader has declared a "no limits" friendship with Russian President Vladimir Putin. That’s left Germany, which profits from exporting cars and other goods to China, confronting a particularly difficult dilemma: how much should it rely on a market which, like Russia, might suddenly be closed.

Berlin recognizes that China has changed during President Xi Jinping’s rule and that Germany needs to reduce dependencies in strategic industries, one senior German official said. At the same time, Scholz’s trip demonstrates that Europe’s largest economy views China as a key international player vital to addressing the world’s most pressing challenges, said the official who requested anonymity to share policy goals before the visit.

"We don't want decoupling from China. But what does China want?" Scholz wrote Wednesday, in a guest article for German newspaper Frankfurter Allgemeine Zeitung, while reiterating his commitment to "reducing one-sided dependencies."

That balancing act has become tougher in the more than three years since then-Chancellor Angela Merkel — an advocate for engagement with both China and Russia — led the last German delegation to Beijing. Besides the war in Ukraine, ties between the two sides have been strained by China’s crackdown on Hong Kong, tit-for-tat European sanctions over the alleged oppression of Muslims in Xinjiang and a Covid policy that has all-but locked out overseas business travelers.

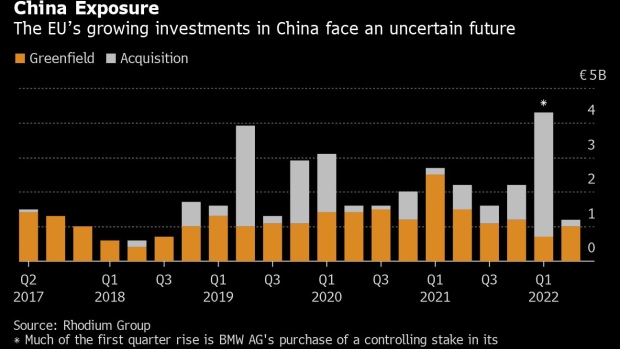

Germany’s longtime trade surplus with China has swung into deficit as the Asian country’s economy slows. While chemicals giant BASF and German carmakers were responsible for billions of euros of new investments in recent months, small and medium-sized European firms have largely frozen or reduced their commitments, according to the Rhodium Group.

Xi has sought to maintain business ties with Europe as a bulwark against US President Joe Biden’s efforts to build a tighter coalition of liberal democracies. The Chinese leader, who secured a third term last month, has brushed off European criticism on issues like human rights and Ukraine, urging Brussels to stay out of its internal affairs and embrace a more independent policy from Washington.

Top EU diplomat, Josep Borrell, said in a speech last month that the world in which the European Union could rely on the US for its security and China and Russia for its prosperity was “no longer there.”

“We have entered a new phase in Europe-China relations,” said Noah Barkin, managing editor of the Rhodium Group’s China practice. “Xi Jinping’s partnership with Vladimir Putin, at a time when Russia is waging a brutal war of aggression in Europe, has reinforced the view in European capitals that China is first and foremost a rival and competitor.”

Many in Europe, such as French President Emmanuel Macron, share Germany’s concerns about joining the US’s increasingly confrontational and ideological showdown with China. They advocate a more nuanced approach that keeps Beijing as a trade partner, with Scholz telling a business conference last month that “decoupling is the wrong answer,” even as they seek to diversify.

European leaders balked at the Biden administration’s efforts to get them to join in restricting China’s access to semiconductor technology, according to people familiar with the matter, prompting the US to move ahead unilaterally. Some senior EU officials believe Washington is too preoccupied with Beijing at the expense of other concerns, said a diplomat familiar with the discussions.

European unity on China, however, largely ends there. Former Soviet bloc countries have increasingly come to view Beijing’s economic influence over the continent with suspicion, a concern driven home by China’s trade embargo on Lithuania over its pursuit of closer ties with Taiwan.

Meanwhile, others such as Hungary continue to court Beijing. China is among several issues Scholz and Macron have struggled to get aligned on in recent months.

“What is challenging in the context of China is how broad the spectrum of the national policies and priorities toward China is,” said Grzegorz Stec, an analyst at the Mercator Institute for China Studies. “That divergence of views creates a circle of interests that’s hard to square in a single strategy.”

Scholz stressed in the Wednesday article that the German side had coordinated closely with European partners, including Macron, in the run up to his trip. “When I travel to Beijing as German chancellor, I do so also as a European,” he wrote.

Read More: US Suggests EU Consider Using Export Limits to Target China

Scholz also faces calls for a firmer China policy after pushing through a deal to allow Chinese state firm Cosco Shipping Holdings Co. to buy a 24.9% stake in one of Hamburg’s port terminals. The transaction was opposed by many in his cabinet, and German Green Party leader Omid Nouripour, a member of the ruling coalition, said there could be no more “business as usual” with China.

European views toward China’s domestic market, where multinationals are facing stiffer competition from home-grown brands, are also souring. Carmakers such as BYD Co. and Geely Automobile Holdings Ltd. accounted for almost 80% of the country’s electric vehicle sales in the first seven months of this year, according to China’s Passenger Car Association. Increasingly, they’re challenging European brands overseas, as well.

“It’s not the big China market story it used to be,” said Joerg Wuttke, president of the European Union Chamber of Commerce in China and BASF’s chief representative in the country. “We have a completely different soundtrack from our home base. That definitely makes operations in China more complex and difficult.”

The automotive industry is one of Germany’s main economic engines, employing almost 800,000 people and generating the most revenue of any industrial sector in the country. VW, Mercedes and BMW have built dozens of factories in China with local partners they were forced to share technology with, and all three manufacturers now sell more vehicles in China than any other market. Getting squeezed out of the Chinese market would cascade from Germany’s carmakers to hundreds of smaller suppliers.

The trip is being watched for signs of a thaw after a difficult summit between Chinese and European leaders in April, weeks after Russia’s invasion of Ukraine, according to a European diplomat in Beijing.

Even so, Europe’s rapid unraveling ties with Russia have forced German companies to confront the once unthinkable: a rushed exit from the Chinese market. Industry leaders are already planning for a worst-case scenario in which China enters a conflict over Taiwan and Germany backs sanctions against Beijing, according to a person familiar with discussions, who asked not to be named discussing internal deliberations.

What Scholz can accomplish during such a brief visit remains to be seen. The high-level delegation — also including executives from Mercedes-Benz AG, Adidas AG, BMW AG and Siemens AG — indicates business deals could be announced or at least reaffirmed. But he wrote Wednesday that he won’t ignore "difficult topics" including respect for civil and political liberties and the rights of ethnic minorities in Xinjiang.

There’s also the risk that the trip reinforces Chinese views that they can play Europe’s various capitals against each other, said Ivana Karásková, China research fellow at the Prague-based Association for International Affairs.

“These solo activities will hardly strengthen the unity of the EU when it comes to China,” she said. “It will, yet again, give China an impression that EU lacks one single voice and that member states may be corrupted by bilateral deals.”

--With assistance from Alberto Nardelli, James Mayger, Jillian Deutsch, Jenny Leonard, Colum Murphy, Stefan Nicola, Jorge Valero and John Follain.

©2022 Bloomberg L.P.