Jul 20, 2022

Ghana Producer Inflation at Eight-Year High Before Rate Decision

, Bloomberg News

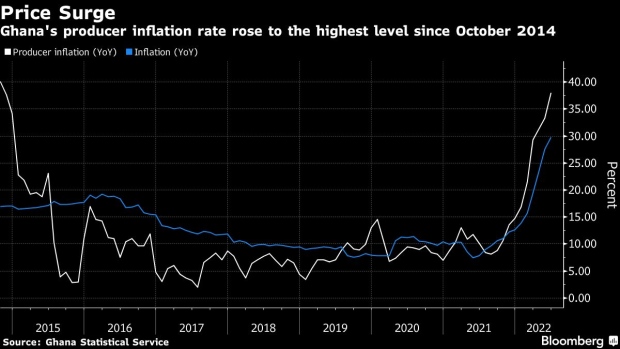

(Bloomberg) -- Ghana’s central bank may raise borrowing costs Monday after producer inflation quickened to a near-eight-year high, with the highest rate of change since March suggesting price pressures are building.

Annual producer inflation accelerated for a 10th straight month to 38% in June, compared with a revised 33.3% the previous month, according to data from the Ghana Statistical Services. That’s the highest level since October 2014 and was stoked by rising fuel, food and beverage prices, and a weakening currency.

The cedi has declined 26% against the dollar this year -- making it the second-worst performing currency in the world, of those tracked by Bloomberg, after the Sri Lankan rupee.

The sustained increase in producer prices and the weakening currency may further fan consumer inflation that quickened to a 19-year high in June -- albeit at a slower pace than the three previous months. That may persuade the monetary policy committee that started deliberating on interest rates Wednesday to hike on July 25. Africa’s second-most aggressive central bank, after Zimbabwe, has raised rates by 450 basis points this year.

©2022 Bloomberg L.P.