Apr 4, 2023

Gold Holds Surge Past $2,000 With Record High Suddenly in Sight

, Bloomberg News

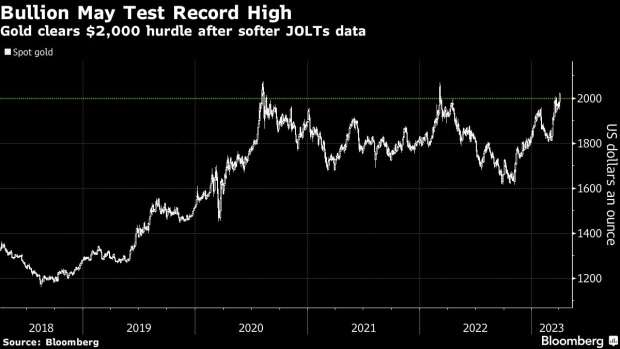

(Bloomberg) -- Gold edged slightly higher, hovering above $2,000 an ounce with traders assessing the Federal Reserve’s interest-rate path following weaker-than-expected economic data from the US.

The US service sector expanded in March at a much slower pace than projected on considerably softer growth in new orders and business activity. Companies added fewer jobs than forecast while wage growth slowed, underscoring labor demand that’s showing some signs of cooling. The dollar and Treasuries advanced in response as recession concerns resurfaced. That weighed on bullion as it’s priced in the greenback.

Still, the precious metal remains above the key level and is eying an all-time high of $2,075.47 set in August 2020, suggesting continued demand from investors seeking safety on the back of elevated inflation, a weakening labor market, tight liquidity and brittle credit.

“We have always viewed gold as a hedge in a portfolio context, and its safe-haven qualities have shined through again during the latest market turbulence,” UBS Group AG strategists, including Giovanni Staunovo, said in a note. The analysts see bullion eventually breaking its previous record to test $2,200 an ounce by early 2024.

Spot gold was up 0.1% to $2,021.98 an ounce as of 2:21 p.m. in New York.

--With assistance from Eddie Spence, Jason Scott and Sybilla Gross.

©2023 Bloomberg L.P.