Dec 13, 2019

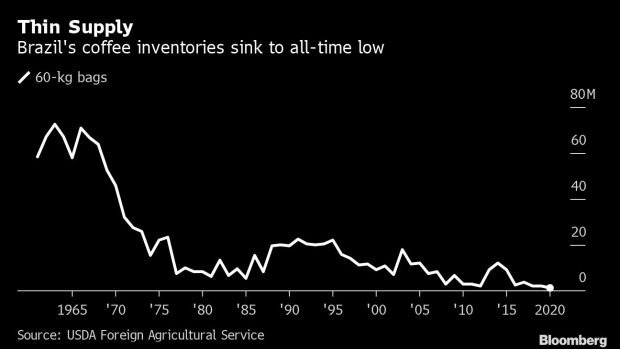

Hedge Funds Grow More Bullish on Coffee as Brazil’s Reserves Vanish

, Bloomberg News

(Bloomberg) -- Top coffee supplier Brazil is running out of reserves, and investors are taking note.

In the season ending Sept. 30, Brazilian reserves may plummet to the lowest since at least in 1962, when U.S. government records begin, according to Department of Agriculture projections released Friday.

While a lower crop this year is partly responsible for the slide, record domestic use in Brazil and world demand is taking every bean grown in the country. Global output growth stagnated in recent years because low prices discouraged investments in countries like Colombia and Central America. To be sure, a bigger biennial crop in 2020-21 in Brazil may bring relief to supplies.

Arabica coffee futures in New York on Friday capped a fourth straight weekly gain and are up about 30% this quarter, the top performer among major traded commodities. That’s after prices reached the lowest level since 2005 earlier this year.

As of Dec. 10, hedge funds had increased their net-bullish holdings on arabica futures and options to the highest in three years, Commodity Futures Trading Commission data showed Friday. The data also showed gross shorts by commercial traders, which includes producers, are rising, as they sold on rallies.

To contact the reporters on this story: Marvin G. Perez in New York at mperez71@bloomberg.net;Dominic Carey in Washington D.C. at dcarey5@bloomberg.net

To contact the editors responsible for this story: James Attwood at jattwood3@bloomberg.net, Patrick McKiernan

©2019 Bloomberg L.P.