Oct 27, 2022

Hong Kong Plans to Legalize Retail Crypto Trading to Become Hub

, Bloomberg News

(Bloomberg) -- Hong Kong is pivoting toward a friendlier regulatory regime for cryptocurrencies with a plan to legalize retail trading, contrasting with the city’s skeptical stance of recent years and the ban in place in mainland China.

A planned mandatory licensing program for crypto platforms set to be enforced in March next year will allow retail trading, according to people familiar with the matter, who asked not to be named because the information isn’t public.

Regulators are seeking to allow listings of bigger tokens but won’t endorse specific coins like Bitcoin or Ether, the people said, adding the details and timetable have yet to be finalized as a public consultation is due first.

The government is expected to flesh out its recently stated goal of creating a top crypto hub at a fintech conference starting Monday. The push comes amid a broader drive to restore Hong Kong’s credentials as a finance center after years of political turmoil and Covid curbs sparked a talent exodus.

“Introducing mandatory licensing in Hong Kong is just one of the important things regulators have to do,” said Gary Tiu, executive director at crypto firm BC Technology Group Ltd. “They can’t forever effectively close the needs of retail investors.”

Listing Criteria

The upcoming regime for listing tokens on retail exchanges is likely to include criteria such as their market value, liquidity and membership of third-party crypto indexes, the people familiar said. That’s similar to the approach for structured products such as warrants, they added.

A spokesperson for Hong Kong’s Securities and Futures Commission declined to comment on the details of the new stance.

Shares of some crypto-related firms listed in Hong Kong rose on Friday. BC Technology gained as much as 4.8% to the highest in three weeks, while Huobi Technology Holdings Ltd. edged higher.

Regulators globally are grappling with how to oversee the volatile digital-asset sector, which is picking up the pieces of a $2 trillion rout since a peak in November 2021. The crash toppled a range of crypto outfits while exposing unbridled leverage and deficient risk management.

Singapore, Hong Kong’s traditional rival for financial business, was buffeted by the implosion and has tightened up its digital-asset rules to curb retail trading. Singapore earlier this week proposed banning leveraged retail token purchases. China declared the crypto sector largely illegal a year ago.

Hong Kong has actually been trying to frame an all-encompassing crypto regime going beyond retail token trading, said Michel Lee, executive president of digital-asset specialist HashKey Group.

‘Grow the Ecosystem’

He cited tokenized versions of stocks and bonds as a potentially more important segment in future. “Just trading digital assets on its own is not the goal,” Lee said. “The goal is really to grow the ecosystem.”

Hong Kong used to be a base for big exchanges like Binance and FTX. They were lured by a laissez faire reputation and close ties with China. In 2018 the city introduced a voluntary licensing regime that restricted crypto platforms to clients with portfolios of at least HK$8 million ($1 million).

Only two firms were approved for permits, BC Group and HashKey. The signal of a tough approach effectively turned away the more lucrative consumer-facing business, spurring FTX to decamp to the Bahamas last year.

Questions remain as to whether Hong Kong’s plan to woo crypto entrepreneurs back is too little, too late. For instance, it remains unclear if mainland Chinese investors would be able to trade in tokens via Hong Kong.

“The kind of conversations I’ve had was that people still fear there’ll be a very strict licensing regime,” said Leonhard Weese, co-founder of the Bitcoin Association of Hong Kong. “Even if they’re able to deal directly with retail users, they’re still not going to be as attractive or as competitive as overseas platforms.”

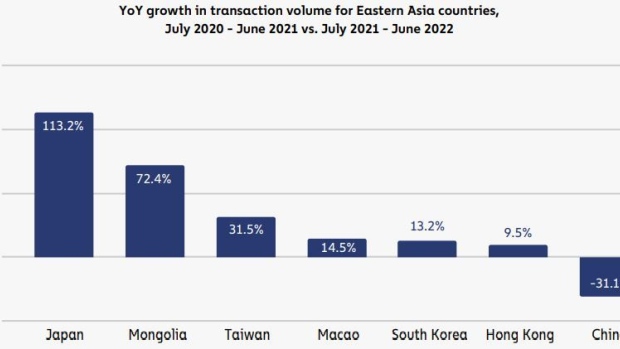

Digital-token transaction volume in Hong Kong expanded less than 10% in the 12 months through June from a year earlier, the least in East Asia outside of a slump in China, according to blockchain specialist Chainalysis Inc. The city’s overall global ranking for crypto adoption fell to 46 in 2022 from 39 in 2021.

Other possible steps in Hong Kong include establishing a regime to authorize exchange-traded funds offering exposure to mainstream virtual assets, according to Elizabeth Wong, the fintech head of the city’s Securities and Futures Commission.

The fact the city can introduce its own crypto framework distinct from China’s shows the one country, two systems principle in action in financial markets, Wong said at an event last week.

--With assistance from Hannah Miller and Joanna Ossinger.

(Updates with share price moves in the eighth paragraph.)

©2022 Bloomberg L.P.