Feb 23, 2022

How Argentina’s IMF Deal Will Test ‘Exceptional’ Criteria Limits

, Bloomberg News

(Bloomberg) -- As the International Monetary Fund staff and Argentina advance on talks for a new agreement, the lender’s board is closely following whether the country meets four key criteria that would allow it to receive a large loan.

In a briefing held last week between the Washington-based institution’s technical staff and its executive board, one of the key topics was how Argentina will continue to meet existing criteria to receive an “exceptional access” loan. The internal category, with requirements created in 2002 to guarantee a responsible use of loans, allows a country to receive financing for more than 100% of its allowance in a single year.

Argentina is in talks for a new $40 billion program to replace a failed one from 2018, and is working against the clock to announce a staff-level deal that includes targets and commitments. That program will then need to be approved by the country’s congress and the IMF’s board of directors to be final.

Read More: Five Key Hurdles Argentina Must Overcome Before a Final IMF Deal

The country will need to meet the requirements in its first loan and in every three-month review that follows, according to Martin Muhleisen, who served as chief of staff to former IMF Managing Director Christine Lagarde.

“The board can approve a program if Argentina doesn’t meet these criteria, but that would be a de facto change in IMF policy that would need to apply to all members,” he added.

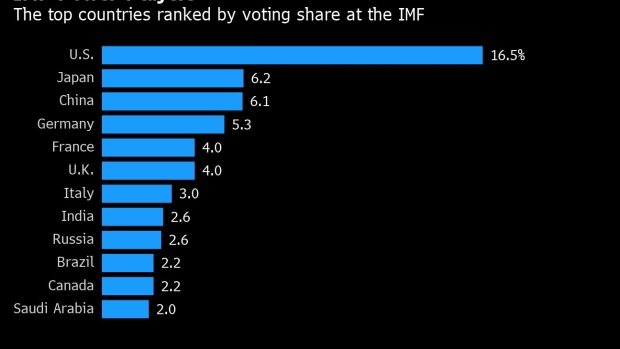

Key board members including the U.S., Germany, and Japan voiced concern in the informal meeting last week over Argentina’s debt sustainability and its ability to regain market access, according to people with knowledge of the matter, who asked not to be named because talks are private. Though the program needs formal approval from just a majority, the group normally operates by consensus.

The IMF’s press office declined to comment.

Argentina’s 2018 failed program represents more than 10 times the country’s quota with the Fund.

Here’s a look at the criteria and how Argentina fits them:

1) Budget needs

The first criteria, which is that a country has a large balance of payments needs, is one that IMF staff and board members alike agree the country meets. Net foreign exchange reserves have fallen close to zero, and the country’s liquid reserves, basically what’s available in cash, are negative.

Read More: Why Argentina, IMF Are Wrestling Over Bad Debt, Again

2) Debt sustainability

With Argentina’s gross public debt to GDP running at 82% according to Buenos Aires-based firm Equilibra, debt sustainability is one of the points that board members have expressed the country may not be able to meet.

Still, there’s precedent for some flexibility. In 2010, the IMF created a “systemic exemption” for Greece, which allowed it to receive a 30 billion euro loan without a debt reduction operation because of concerns that a crisis could lead to severe contagion in the Eurozone. Though the exemption was since removed in 2016, it shows that the criteria can evolve.

“Given Argentina’s situation, I would expect that the staff need to go to the outer limit of interpreting how the criteria are met, and the board would have to buy that interpretation by the staff,” Muhleisen said.

3) Market access

The third factor is regaining market access, which is necessary for the country to pay back its IMF debt after a four-and-a-half year grace period. Argentina restructured $65 billion of overseas private debt in 2020, but bonds continue to trade in distressed levels.

This criterion is “the one that is really difficult for Argentina,” said Mark Rosen, who represented the U.S. at the IMF’s board during the Trump administration. “I’m not sure that’s in the cards for Argentina for some time.”

4) Ownership

The fourth “exceptional access” criteria is political ownership. The Fund will consider it to be fulfilled if congress approves the agreement before the deal reaches its executive board.

Argentina’s opposition, which is more business friendly and which was part of the government that signed the 2018 deal, may be less difficult to convince. For the government, the challenge will be to find support within the most radical-left members of its own Peronist lawmakers.

©2022 Bloomberg L.P.