Jul 15, 2020

How Peacock stands out from the streaming-TV flock

, Bloomberg News

The distinctive Peacock is spreading its feathers, hoping to attract TV fans. But will any take notice?

Comcast Corp.’s new streaming-video app, named for its NBC network’s avian logo, is now available to the masses following an April soft launch that was exclusive to Comcast customers.

Peacock is one of many Netflix copycats to emerge in recent months — a baptism by fire for old-world media giants trying to meet the insatiable demand of consumers forced indoors by a global pandemic and desperate for TV distraction.

Peacock’s arrival comes as its parent company reels from the shutdown of movie theaters, its own Universal theme parks and Hollywood as a whole, while the sports industry’s break from live game play saps TV advertiser demand. (NBC was supposed to broadcast the Tokyo Olympics starting this month.)

It’s a similar situation for Walt Disney Co., another profit fortress breached by the crisis. Their streaming initiatives have become the mitigating factor as another Covid-wrecked earnings season gets underway and as consumers continue to ditch cable TV for internet-powered video apps.

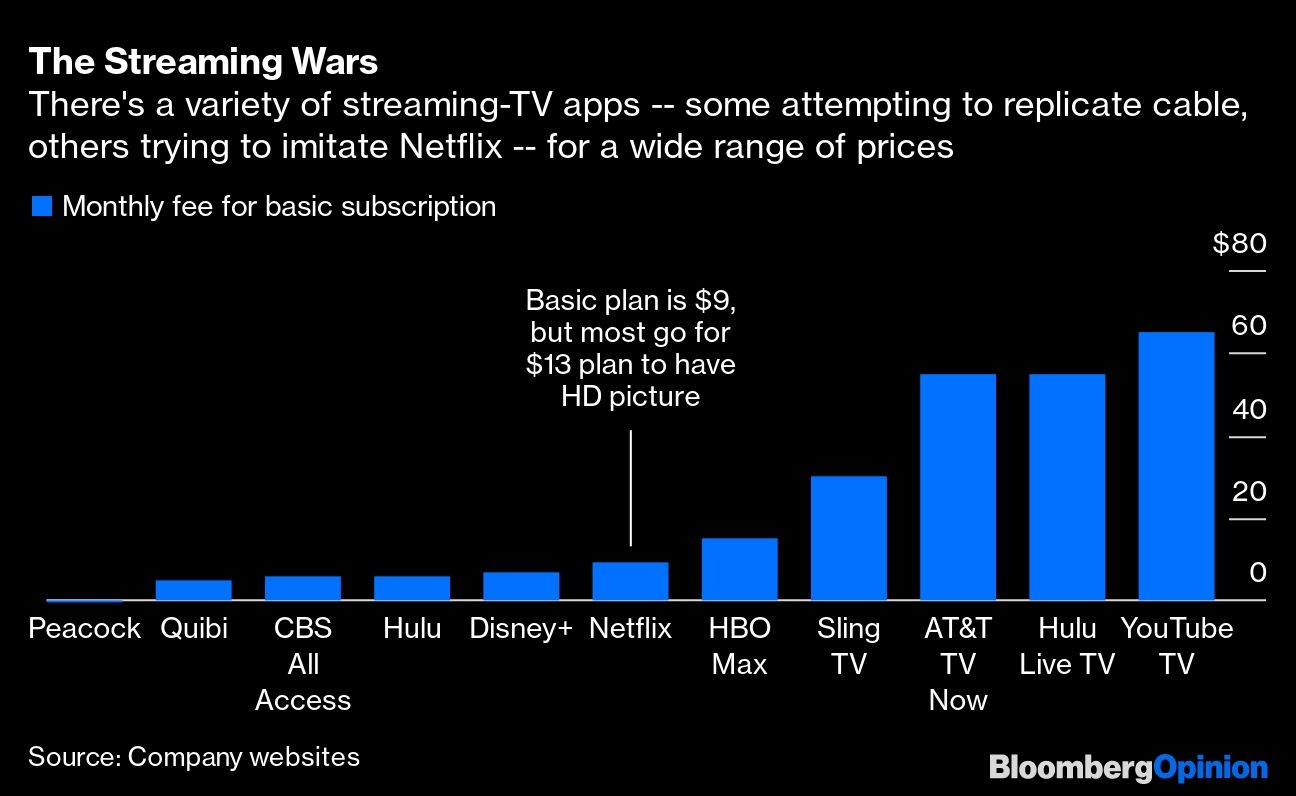

Peacock, like its spirit animal, stands out among the flock. The app contains ads and features a free version, while Comcast’s rivals are hiking subscription prices and resisting ads (though it may be only a matter of time before they cave to the economics). For example, Google’s YouTube TV, a collection of about 80 live channels, just upped its steep monthly fee from US$50 to US$65.

But what really sets Comcast apart is that instead of chasing Netflix’s unsustainable business model, Comcast is sticking to a familiar playbook that caters to its own core strengths: its internet service and bundling capabilities.

Peacock Premium costs US$5 a month, but Comcast Xfinity internet subscribers get it for no extra charge using the free Xfinity Flex device. Why all the freebies, you ask?

It’s not entirely out of the kindness of CEO Brian Roberts’s heart. Flex, a dashboard for accessing your streaming apps in one Comcast-controlled place, is a likely precursor to the company offering new types of internet and streaming subscription bundles as it becomes harder to sign up new internet users.

Bundles also help reduce churn. Matthew Strauss, the former head of Xfinity Services, predicted during an interview in September that there would soon be a “great re-bundling” in the industry. Now, he’s the head of Peacock.

The idea is to keep customers — and their data — within the Comcast ecosystem to generate ad dollars.

Even though ad spending has fallen sharply amid the pandemic, there’s expected to be solid long-term demand to target streaming audiences. But while the company wants as many people as possible using Peacock, it also wants to maintain control over those lucrative relationships.

That’s probably the reason it hasn’t struck a deal yet for Peacock to be carried on Roku or Amazon Fire TV. Both platforms together have a 63 per cent share of connected-TV viewing time, according to Conviva. Not being on them will hurt Peacock.

As it is, Peacock is still living in relative obscurity. Its Twitter and Instagram handles have less than 80,000 followers combined, compared with more than 4 million for Disney+, which launched in November with a massive marketing push.

At one point it was impossible to avoid Disney+ promotions — at the mall, on highway billboards, in subways. Of course, fewer people are venturing out to those places nowadays, so Peacock must rely on a digital push instead.

Like Disney+, Peacock offers a fairly limited library centered on in-house content and reruns of beloved series such as “The Office,” which is coming to the service next year.

It’s not much of a plumage, but the content limitations are partly due to Covid-19 sending production crews and actors home for months on end. The free version of Peacock may still be a welcome addition for anyone running out of things to watch and scraping the depths of their Netflix libraries.

Over time, the fuller paid version may even appeal to viewers as the Goldlilocks choice between expensive services like YouTube TV and more niche apps like Disney+.

Peacock could be a good complement to a Netflix subscription, which is the best any app can hope to be at this point. But that’s if it can get the attention of anyone outside the Comcast base.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tara Lachapelle is a Bloomberg Opinion columnist covering the business of entertainment and telecommunications, as well as broader deals. She previously wrote an M&A column for Bloomberg News.