Mar 5, 2020

HP rejects Xerox's hostile takeover offer, calling bid too low

, Bloomberg News

HP Rejects Xerox Offer as Too Low

HP Inc. said it has rejected an unsolicited takeover offer from Xerox Holdings Corp. and has asked shareholders not to tender their shares.

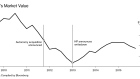

The US$34 billion offer “meaningfully undervalues HP and disproportionately benefits Xerox shareholders,” the Palo Alto, California-based company said in a statement on Thursday. Xerox’s “urgency” in launching the offer shows its “desperation to acquire HP to address its continued business decline.”

Xerox has pitched HP investors on a cash-and-stock offer worth US$24 a share. For each HP share, a holder would receive US$18.40 in cash and 0.149 Xerox shares. The offer is set to expire April 21, Norwalk, Connecticut-based Xerox said Monday in a statement.

HP, which has a large printing business, has said in the past that it has many routes to create value that aren’t dependent on a combination with Xerox. Chief Executive Officer Enrique Lores is still new to HP’s top job, and has sought to make his mark on a company he’s worked at for more than three decades.

Lores wants to make printing services, 3-D printing and high-end computers a larger part of HP’s business, and would oversee as much as a 16 per cent reduction in the company’s workforce in a bid to cut costs. Xerox CEO John Visentin has criticized this plan as a piecemeal approach that won’t be as beneficial to HP as a combination.