Sep 6, 2022

HSBC, Goldman Take Knife to Yen Forecasts on Key 140 Level Break

, Bloomberg News

(Bloomberg) -- HSBC Holdings Plc is the latest of the biggest names in finance to slash their expectations for the yen, as the Japanese currency teeters on the verge of its worst-ever annual decline.

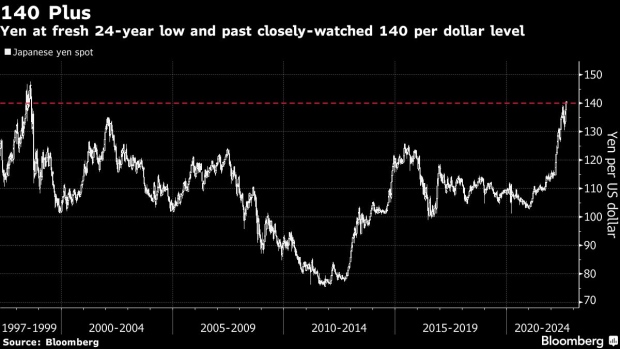

Strategists at the UK bank see the yen potentially weakening beyond 145 per dollar in the coming months, extending a 24-year low, even though they remain ‘contrarian’ bulls.

That mirrors similar calls recently from Goldman Sachs Group Inc. and Mizuho Securities, as analysts recalculate the impact of an increasingly hawkish Federal Reserve and a Bank of Japan more than willing to buck the global monetary tightening trend.

The yen slipped 0.2% to just under the 141 level Tuesday. It has fallen more than 18% this year and is closing in on 1979’s record annual decline of 19.2%.

“We now see dollar-yen staying above 140 in the coming months -- potentially overshooting to beyond 145 -- and then falling slightly faster in the second half of 2023 to eventually end next year at 130,” HSBC strategists including Paul Mackel wrote Monday. “We delay our view for a recovery by the very undervalued yen to 2023.”

The yen slumped past the key psychological level of 140 per dollar for the first time in almost a quarter of a century this month as traders refocused on the widening yield gap between the US and Japan. That encourages investors to seek out the more attractive returns in dollar assets from money-market instruments to fixed-income securities.

The factors undermining the currency remain intact with US yields climbing, elevated oil prices heaping pressure on Japan’s trade deficits and little chance of a policy tweak in the near-term from a resolute BOJ.

Goldman Sachs analysts including Kamakshya Trivedi see dollar-yen hitting 145 within three months, up from a previous forecast of 125, they wrote in a note this month.

Record Decline

Back in Tokyo, Masafumi Yamamoto, chief currency strategist at Mizuho Securities, raised his dollar-yen forecast to 144 by year-end from 138, citing a lack of any signs of BOJ monetary tightening for a while.

“The move is in line with fundamentals of widening yield gap,” he wrote Monday. “Markets have only to wait for US rate hike cycle to finish.”

BOJ Should Eye Exit Steps While Holding Policy, Ex-Official Says

Still both HSBC and Goldman see a peak in dollar-yen in coming months for reasons including valuation and the risk the BOJ does make tweaks to its super-loose policy as inflation rises. HSBC also cites the possibility that Japanese investors, fed up with sky-high hedging costs, dial back on paying for protection from currency moves, helping to underpin the yen.

For dollar-yen, “we still think that the trajectory of a modest decline is the right one,” the strategists wrote.

©2022 Bloomberg L.P.