Sep 19, 2023

Illinois Police Pension Fund Plans to Start Investing in Loans and Private Credit

, Bloomberg News

(Bloomberg) -- Illinois’s local police pension fund, set to manage around $11 billion if it clears a court challenge, is looking to hire money managers to help it start buying leveraged loans, and said it plans to eventually invest in private credit.

The Illinois Police Officers’ Pension Investment Fund aims to allocate about $300 million into leveraged loans, moving the money from junk bond index funds, according to a document. The fund’s staff will recommend a manager and the allocation to the board in December, said Kent Custer, chief investment officer for the fund.

“It’s all about returns at the appropriate level of risk. We are trying to make as much money as possible,” Custer said in an interview. “Bank loans are a very appropriate way and prudent way to diversify income investments.”

Over the long term, it also plans to start private credit lending, moving the debt to about 5% of its holdings, and to begin investing in private equity, shifting it to 7% of its assets, according to a document posted on Monday. Its plan for private market investments is still under development, Custer said.

The fund is ramping up its holdings in fixed-income assets that have become increasingly popular among investors, but its decision to diversify is a long-term strategy rather than a response to the performance of these markets and securities this year, Custer said. The fund’s bias will be toward quality in its portfolio, he said.

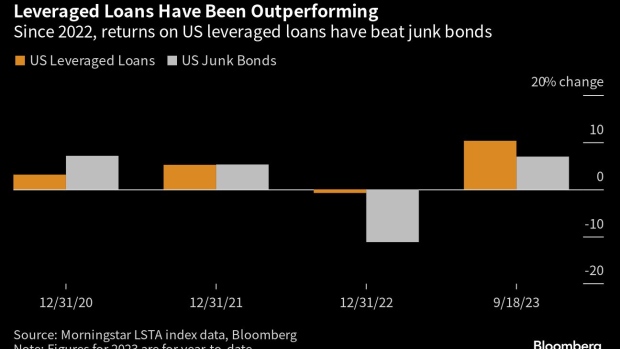

US leveraged loans have gained about 10% this year, while most fixed-rate bonds in the US have eked returns of around 2% or less, or even generated losses.

Once Shunned Loans Are Now a Market Darling: Credit Weekly

And private credit has grown into a $1.5 trillion market globally, from just over $300 billion at the end of 2010, according to financial data provider Preqin. The Cliffwater Direct Lending Index, which tracks a subset of the private credit universe, has gained about 5.6% this year.

Shifting money into alternative investments like private credit and leveraged buyout funds has become increasingly common among public pensions for the last two decades as they’ve sought to boost returns. About 34% of state and local pension assets were in alternative assets in 2022, up from 9% in 2001, according to the Center for Retirement Research at Boston College.

Facing Litigation

The fund is currently asking leveraged loan managers to bid for its business, and said it’s open to limited exposure to collateralized loan obligations and junk bonds as part of its loan strategies. It’s not sure how many managers it will hire, and is willing to consider separately managed accounts, commingled funds, exchange traded funds, or other vehicles, it said. The schedule for selecting managers includes final approval in mid-December, but the time table is subject to change.

The fund was created by a 2019 law to merge assets from local police forces across the state, excluding Chicago, to cut costs and improve performance. It has consolidated about $9.4 billion of assets now. But about a dozen plans whose $1.5 billion of assets would be consolidated into the bigger fund are suing to block the move, and the Illinois Supreme Court is expected to weigh in on the case.

The state’s highest court is currently accepting briefs from each side. The earliest it could hear the case would be Nov. 14.

The plaintiffs argue that the law strips them of authority to make decisions regarding retirement assets, and requires pension beneficiaries to bear the cost of the transfers. Illinois Governor J.B. Pritzker, among the defendants in the case, had championed the pooling of around 650 downstate and suburban firefighter and police pension funds into two. He was looking to address the chronic underfunding that has plagued state and local pension systems across Illinois for years.

The deadline to pool assets was June 30, 2022. The fire fund has completed its consolidation and the police fund is close.

“We are progressing to implement the consolidation basically in parallel with the court case,” Richard White, the executive director of the fund, said in an interview. “Our board has made the decision to go forward with the investment program and to go into our long-term asset allocation.”

©2023 Bloomberg L.P.