Aug 5, 2022

Invesco Sees Value in Canada Corporates With BOC Under Pressure

, Bloomberg News

(Bloomberg) -- Canadian corporate debt looks attractively priced as the central bank nears the end of its rate-hiking cycle and with inflation poised to decelerate, according to Invesco Ltd.’s Avi Hooper.

The Bank of Canada will likely raise its policy rate another percentage point this year, to 3.5%, and then hold it there through 2023, the portfolio manager said in an interview with Bloomberg News.

Inflation, which was 8.1% in June, should ease but not quickly enough to allow Governor Tiff Macklem to begin cutting rates -- not when it’s under extreme pressure to “regain its credibility with regards to inflation targeting,” Hooper said.

Canada’s yield curve has inverted, with two-year benchmark government bonds yielding 47 basis points more than 10-year debt, as of Friday morning at 10:47 a.m. New York time. That’s close to the steepest inversion between Canada twos and tens since 1990 -- a signal that the market sees a high probability of a sharp slowdown or recession.

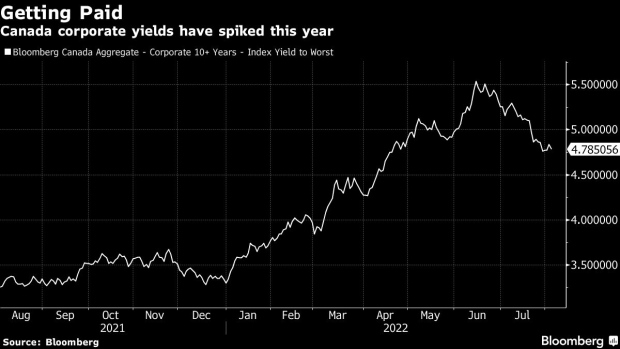

Corporate yields are significantly higher than they were at the start of the year and spreads with government bonds have widened. That compensates investors for the economic risks, Hooper said.

“Outright yields are the most attractive in over a decade. So your valuation is already arguably pricing in this prospect of a recession,” Hooper said. “You can find high quality, very profitable corporate bonds in the five-to-10 year part of the curve.”

Energy company bonds look good, he said, as oil and gas firms are producing prodigious amounts of cash flow and are repaying debt instead of spending big on large new projects. The Invesco Canadian Core Plus Bond Fund, which Hooper manages with a team of others, also held the bonds of telecom Bell Canada and Choice Properties Real Estate Investment Trust, the real estate company of Canada’s billionaire Weston family, as of June 30.

Canadian employment unexpectedly fell for a second straight month in July as workers dropped out of the labor force, adding to evidence of a slowdown. The country shed 30,600 jobs last month, a surprise negative reading compared to the 15,000 gain anticipated by economists.

©2022 Bloomberg L.P.