Mar 5, 2020

James Bond Movie Delay Jolts Cinema and Restaurant Stocks

, Bloomberg News

(Bloomberg) -- The postponed release of the latest James Bond movie due to the coronavirus outbreak has left more than just 007 fans feeling glum.

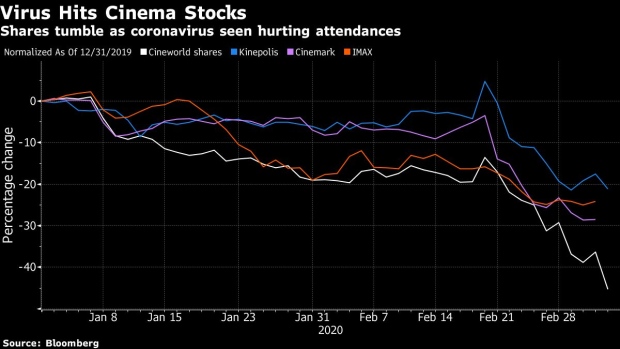

Shares of U.K.-listed cinema operator Cineworld Group Plc plunged as much as 24% as the delay will defer a boost to box-office takings, while U.S. peers also slumped and bond prices fell. And it wasn’t just movie theater stocks feeling the pain: Restaurant Group Plc, many of whose outlets are located near to cinemas, also tumbled.

The release date for the Bond sequel “No Time to Die” was pushed back from April to November late Wednesday, and according to Peel Hunt analyst Ivor Jones the postponement is unlikely to be the last. Jones noted that the top 10 movies will account for about 40% of box-office revenue in a typical year.

“Films are expensive to produce and promote and, with many Asian cinemas closed, and the prospect of, at best, reduced audiences elsewhere, other producers of major films may choose to delay release,” the analyst wrote in a note as he cut his recommendation on Cineworld to hold from buy.

The plunge for U.K.-listed Cineworld -- which also owns the Regal chain in the U.S. and last year announced a deal to buy Canada’s Cineplex Inc. -- was its biggest on record, and extended a year-to-date plunge to more than 45%.

In New York, Cinemark Holdings Inc. fell 7.1%, IMAX Corp. slid 6.6% and AMC Entertainment Holdings Inc. dropped 10%. And in Belgium, cinema operator Kinepolis Group NV retreated 8.5%, while projector-maker Barco NV descended as much as 6.2%.

Loans from European chain Vue were bid lower, according to three people familiar with the matter, and sterling bonds from AMC also slid.

Restaurant Group, whose outlets include Frankie & Benny’s and Wagamama, tumbled as much as 18% in London. That took the stock’s decline for the year to date to more than 50%. Previous Bond releases have provided a short-term boost to sales for the company.

Given a high proportion of the cost base of cinema companies is fixed, anything that affects admissions can have a material impact on earnings, JPMorgan analyst Alexander Mees said by email.

“It would have been problematic for the industry to see one of its big hopes fall flat at the box office,” Mees wrote. “In that regard, it makes sense to delay to November when hopefully the situation will have calmed down.”

--With assistance from Marianna Aragao and Sarah Husband.

To contact the reporter on this story: Joe Easton in London at jeaston7@bloomberg.net

To contact the editors responsible for this story: Beth Mellor at bmellor@bloomberg.net, Paul Jarvis

©2020 Bloomberg L.P.