Sep 19, 2019

Japan Inflation Hits 2-Year Low as BOJ Stokes Easing Speculation

, Bloomberg News

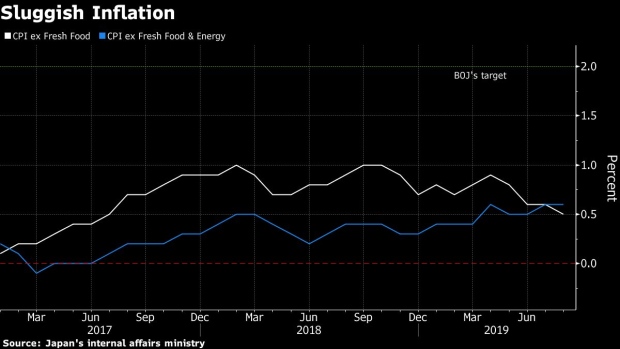

(Bloomberg) -- Japan’s key consumer price gauge hit the lowest level since 2017, as the Bank of Japan fans speculation of additional stimulus at its policy meeting next month.

Consumer prices excluding fresh food rose 0.5% in August from a year earlier, matching economists’ median estimate, according to the internal affairs ministry.

Key Insights

- BOJ Governor Haruhiko Kuroda said Thursday that he was more positive toward easing than at last month’s meeting, and needed to pay closer attention to the possibility of losing momentum toward its 2% inflation target as overseas economies decelerate.

- Japan’s key inflation gauge hasn’t risen above 1% in years, and is expected to remain subdued in the coming months as lower mobile phone service fees and education costs weigh on prices.

- A 2% sales tax hike in October may hit consumer spending, which has helped prop up economic growth during an export slump this year, even as it gives a technical boost to inflation in the short term.

What Bloomberg’s Economists Say

“Looking ahead, we expect core inflation (ex fresh food) to slow to 0.3% toward year-end. Policy-related factors -- lower mobile phone service charges and reduced education costs -- are the major drivers. A hike in the sales tax to 10% from 8% in October could boost headline inflation by 1 percentage point from that baseline forecast.”

-- Asia Economist Team

Click here to read more

Get More

- Overall consumer prices rose 0.3% in August, matching economists’ median forecast.

- Stripping out energy and fresh food, consumer prices climbed 0.6%. Economists forecast a 0.5% gain.

--With assistance from Tomoko Sato.

To contact the reporter on this story: Yoshiaki Nohara in Tokyo at ynohara1@bloomberg.net

To contact the editors responsible for this story: Malcolm Scott at mscott23@bloomberg.net, Jason Clenfield, Henry Hoenig

©2019 Bloomberg L.P.