Mar 6, 2024

Japan’s Wage Gains Beat Consensus at Fastest Pace Since June

, Bloomberg News

(Bloomberg) -- Speculation surged that the Bank of Japan will move this month to raise interest rates for the first time since 2007, after a flurry of reports and wage figures helped drive up the yen, bond yields and overnight swaps.

Bets on the March 18-19 meeting are gaining traction as reports emerge that some BOJ officials favor an early move while some government officials also support a rate hike. Economists and investors are largely in agreement that the central bank will scrap the world’s last remaining negative rate either this month or in April.

The yen rallied as much as 1.2% against the dollar Thursday, the strongest in over a month, supported by a rise in government bond yields after the wage data and remarks from a BOJ board member. Meanwhile, labor unions made the strongest pay demands in three decades. Volatile overnight swaps put the chance of a March rate hike at nearly 80%.

“All of a sudden March looks like it’s live, and just a few weeks ago that was much less clear,” said Michael Metcalfe, global head of macro strategy at State Street Global Markets. “The BOJ has a history of surprising the market, and it doesn’t seem to do forward guidance like other central banks, so there is going to be volatility around and ahead of the meetings.”

BOJ officials are getting more confident over the strength of wage growth, according to people familiar with the matter, a view board member Junko Nakagawa backed on Thursday.

“There are signs of a clear shift in businesses’ behavior for setting wages,” Nakagawa said during a speech in Shimane, western Japan. “Japan’s economy and inflation are steadily making progress toward meeting the stable 2% inflation target.”

Read more: BOJ Is Said to Gain Confidence in Wage Growth Before Rate Call

A consensus has yet to clearly emerge among officials on whether the central bank should move at the end of its March policy meeting or wait until April. While some officials back the BOJ raising rates this month given the strength in wages, others take the view that the bank won’t be able to confirm the price target is in sight by then.

Those reports combined with a steady stream of positive wage data helped push 10-year government bond yields to above 0.7%. The yen traded stronger than 148 per dollar as traders rushed cover short yen positions and buy options protecting against a strengthening of Japanese currency. It trimmed its climb later in the session amid cautious positioning ahead of US jobs data Friday and a US inflation report next week.

“The yen move is largely reflective of better data and the massive net short position in place right now,” said Bipan Rai, CIBC’s global head of foreign-exchange strategy in Toronto. “Barring a tweak to the yield-curve control, I suspect we won’t get much yen strength if it’s just a removal of the negative interest rate policy.”

What Bloomberg Economics Says...

“Our view is that the bar is high for the BOJ. Before it considers shifting policy, we think it will want to confirm wage growth will keep its brisk pace ”

— Taro Kimura, economist

For the full report, click here.

Wages have emerged as the final piece in the puzzle as the BOJ prepares to take the view that its stable inflation target is in sight after the scars of more than a decade of deflation.

While the rest of the global central banking community raced to hike rates as prices soared across the world in the post-pandemic recovery, Japan stood its ground arguing that it needed more evidence that stronger pay could fuel stable inflation that was positive for the economy rather than damaging.

Betting against the yen “has been one of our high conviction carry trades this year and we still have it on,” said Philippe Burke, a fund manager Apache Capital in New York. The trade of weak yen against the US dollar “still has legs,” he said, although he plans to re-evaluate by the end of this month.

The better-than-expected wage data come as annual pay negotiations between management and labor representatives reach a peak, with the initial results from Japan’s biggest union federation expected next week ahead of the BOJ’s meeting.

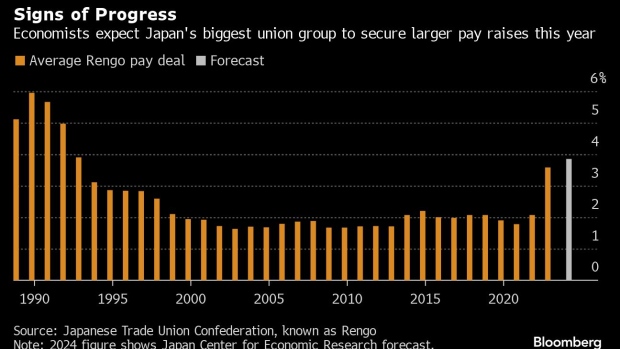

Rengo, Japan’s largest labor union federation, announced in the afternoon that the average demand made by its unions this year was 5.85%, the biggest figure in three decades, compared with an initial figure of 4.49% a year ago. Stronger demands from unions this year will bode well for the initial results of Rengo wage talks due for release on March 15.

Earlier in the day UA Zensen, a labor union consisting of over 1.8 million members from sectors including retail and restaurants, unveiled very early results of its negotiations. They showed full-time workers landing average wage gains of 6.7%, well in excess of the corresponding tally of 5.3% a year ago.

A labor ministry report showed overall monthly cash earnings and a separate set of full-time pay figures rose 2% in January, again suggesting a solid trend already in place.

The figures are likely to boost hopes that wages will outpace inflation, drive consumption and clear the path for the BOJ to raise rates.

The Japanese government has dedicated itself to maintaining salary growth to ensure a complete break from deflation after decades of stagnation following the burst of the nation’s asset price bubble more than 30 years ago.

Prime Minister Fumio Kishida has personally lobbied executives for large wage increases, as he seeks to mollify consumers frustrated over persistent inflation. His government has implemented a number of measures to that end, including tax breaks for companies that raise wages.

The premier reportedly plans to meet with business leaders and union leaders next week for a final push.

--With assistance from Toru Fujioka, Masaki Kondo, Yumi Teso, Daisuke Sakai, Emi Urabe, Sujata Rao, Naomi Tajitsu, Anya Andrianova, Robert Fullem, Carter Johnson and Cristin Flanagan.

(Updates market moves from third paragraph on, adds comment starting from ninth paragraph.)

©2024 Bloomberg L.P.