Jan 23, 2024

Japanese Banks Climb on Bets the BOJ Will Lift Rates This Year

, Bloomberg News

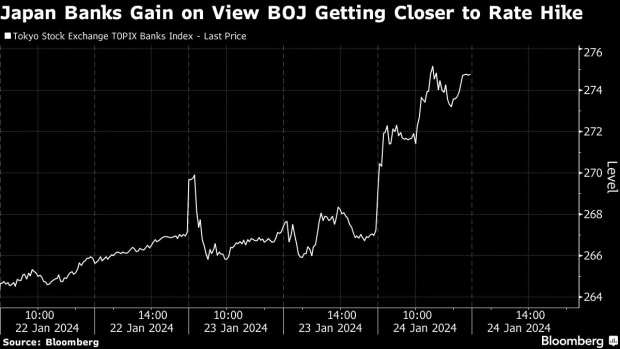

(Bloomberg) -- Japanese banks climbed the most since November on bets the Bank of Japan will end negative interest rates this year sooner than expected, helping boost earnings.

The Topix banking index jumped as much as 2.9% in Wednesday trading. Mitsubishi UFJ Financial Group Inc. advanced as much as 4.3%. Sumitomo Mitsui Financial Group Inc. and Mizuho Financial Group Inc. rose more than 2%.

The BOJ introduced more hawkish language in the central bank’s quarterly outlook report even as it maintained negative interest rates on Tuesday. Governor Kazuo Ueda also said after the decision that the certainty of achieving the BOJ’s projections has continued to gradually increase.

“We are basically seeing the story of interest rates going up,” said Tetsuo Seshimo, a portfolio manager at Saison Asset Management Co. “While monetary tightening is basically a negative story for the stock market, it is a positive counter-force for banks.”

In contrast to banks, the real estate sector was hurt by the expectation for higher rates with the sector’s index dropping as much as 2.1%

Japanese government bonds also dropped on the BOJ’s commentary. The yield on benchmark 10-year notes climbed 8.5 basis points to 0.72%, the highest in more than a month.

“The market is just beginning to prepare for the removal of negative interest rates,” said Atsuko Ishitoya, a strategist at Daiwa Securities Co Ltd. “If the economy improves as the deflationary trend takes off in earnest, it will be a tailwind for the banking industry.”

©2024 Bloomberg L.P.