Aug 25, 2022

Jefferies's Bechtel says short U.K., buy Canada on energy crunch

, Bloomberg News

Post-pandemic boom in the service industry, loonie to see upside: Karl Schamotta

Short the UK pound and buy currencies from commodity exporters, such as the Canadian dollar, is a trading strategy recommended by Jefferies Financial Group Inc.

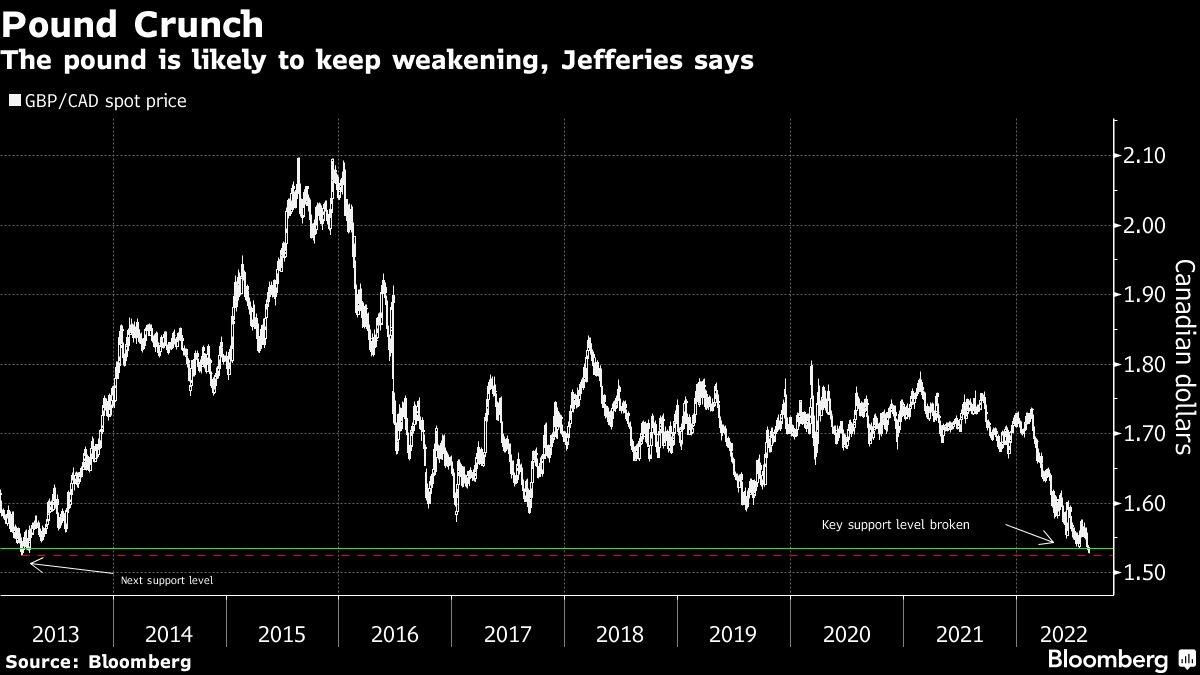

Strategists at the bank are telling clients that there’s still time to profit from the economic upheaval being caused by skyrocketing energy prices. Even though the pound is already weak, it’s likely to keep declining, said Brad Bechtel, the global head of FX.

The pound is already dropped 11 per cent against the Canadian dollar this year, currently trading at CUS$1.5275, the lowest since 2013. If the British economy is stuck in a deep recession during the first quarter of 2023 and oil prices keep rising, Bechtel said he thinks the pound could fall to around CUS$1.45 in a worst-case scenario.

“Getting exposure to some of the energy-producer currencies like Canadian dollar against sterling makes a lot of sense,” he said in an interview.

Bechtel is also urging investors to look at North America as a regional play that can benefit from its energy security relative to the rest of the world and US dollar dominance.

With the American economy relatively strong compared with the rest of the world, those benefits are likely to spill over to Mexico and Canada, he added.

Shorting the pound against the US dollar has been a popular and profitable trade for investors all year. But in addition, investors should consider selling sterling and buying the Mexican peso, Bechtel said.

The pound slipped for a sixth day against the Canadian dollar on Thursday, down 0.1 per cent to US$1.5280. Against the greenback, the UK currency added 0.4 per cent to US$1.1841.