Sep 17, 2020

JPMorgan Asset Says Climate Risks Loom for Brazil, Russia Growth

, Bloomberg News

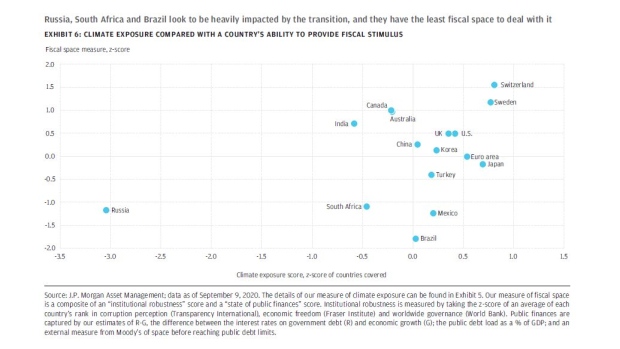

(Bloomberg) -- Emerging markets such as Brazil, Russia and South Africa face a more difficult shift to a low-carbon economy because they lack room to cushion the change by ramping up government spending, according to JPMorgan Asset Management.

The three countries don’t have the headroom to take on more debt to alleviate short-term pain, strategists led by Jennifer Wu wrote in a report Friday, adding India will probably find the transition difficult too. Canada and Australia, also comparatively carbon-intensive, have more room to borrow, they said.

The cost of moving to a low-carbon footprint “either can be borne by today’s households and businesses or it can be financed by public debt and shifted onto future generations, with much of the debt ending up on sovereign balance sheets,” the strategists said. A hybrid approach involves public-private partnerships, they added.

While there’s much uncertainty about the exact impact of climate policies in the most exposed nations, a shift could reduce Russian gross domestic product by more than 6.5% over the next three to four decades, according to the report. Switzerland, the European Union and Japan look more ready for the changes as they rely less on fossil fuels, are willing to make the transition and often lead in green technology, the strategists said.

“The Earth’s atmosphere is changing in ways that have not been seen in some 800,000 years -- the evidence is overwhelming,” the strategists said. Investors “need to take into account important geographical and sector differences in the trajectory of climate policy.”

Renewable energy and green infrastructure stand to gain, while traditional energy, consumer cyclicals, materials and some utilities could be hit hardest. Integrated oil companies’ price-to-book ratios have a positive correlation with a measure of their exposure to technologies underpinning the carbon transition, according to the report.

A reduction in the emissions that contribute to global warming could be achieved via carbon taxes and regulations, debt-funded green stimulus or a combination of both, JPMorgan Asset Management said. Central banks could reorient quantitative easing programs toward greener assets, potentially reducing yields on green bonds relative to others, according to the report.

©2020 Bloomberg L.P.