Mar 27, 2024

Junk Bond Sales in Sterling Surge at Fastest Pace Since 2021

, Bloomberg News

(Bloomberg) -- Junk bond sales in sterling have climbed to the highest in years as signs of a UK economic rebound tempt companies to refinance debt.

Corporate borrowers including UK film studio Pinewood Group and luxury car firm Aston Martin have issued about £2.6 billion ($3.3 billion) in bonds so far in 2024, exceeding full-year sales for both 2023 and 2022, according to data compiled by Bloomberg. The four deals in March makes it the busiest month since October 2021.

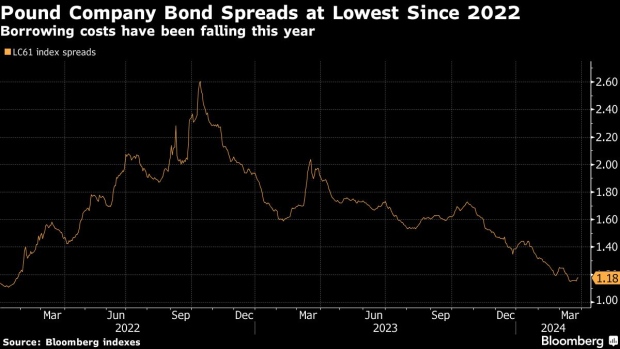

With interest rates much higher than the last time they issued debt, these riskier companies — graded either double or single B by rating agencies — face forking out more to replace old notes. So they are seizing on market borrowing rates easing to a two-year low, following a run of stronger UK economic data and slowing inflation.

“I think it makes complete sense for issuers to get deals done in this market — the books remain very healthily covered for investment grade or high-yield, and spreads have moved a long way already,” said Luke Hickmore, investment director at abrdn plc. “For high-yield in particular this will also, for many issuers, avoid the maturity wall that the asset class has in 2025/6.”

See also: Junk Debt Market Shrinks as Maturity Wall Looms: Credit Weekly

Sterling bond spreads have dropped about 40% versus a year ago. That was reflected in the cost for Ford Motor Co., which issued sterling bonds both this year and in 2023. In January it sold 4.75-year notes at a spread 100 basis points tighter than it had to pay for a 3.25-year bond in February last year.

Many of the deals are to replace existing debt, given there is a looming pile that needs to be repaid in the coming years. Jerrold Finco Plc, more widely known as Together Financial Services, is marketing a new £450 million senior secured note that will refinance one due to mature in 2026, according to a person with knowledge of the matter.

Proceeds from Aston Martin’s £400 million offering on March 13 will also help refinance notes maturing in 2025 and 2026, while Pinewood Finco Plc’s £750 million deal will be used for a partial tender of the firm’s £750 million notes due in 2025, according to people familiar with those transactions.

Firms are still paying a lot more than for old notes, issued when rates were lower. Together, for example, is offering a yield in the range of 8% to 8.25% on the six-year notes callable after two years, whereas its existing 2026 notes pay a coupon of 4.875% and are expected to be called at par. That suggests a pick-up in the region of 3% for investors prepared to take the maturity extension.

Ahead of BOE

The refinancings are emerging even before the Bank of England begins interest-rate cuts, with June earmarked by money markets as the most likely month for it to start reducing the country’s borrowing costs. Firms seem willing to take advantage of the positive sentiment, which has pushed down sterling corporate bond spreads toward the lowest since early 2022.

Another issuer mooting a potential refinancing of existing notes is UK poultry producer Boparan Holdings Ltd. The company has “potentially hauled itself into a position to carry out a par refinancing on the back of improved operational results and a more supportive market backdrop,” CreditSights analysts Maryum Ali and Jahan Miah wrote in a note on Wednesday.

Yet they say Boparan — which struggled with burning cash last year — will likely “have to pay up, with likely higher future coupons set to put further pressure on cash generation.”

Despite the borrowing spree, the size of the junk-rated corporate debt market globally has been shrinking. The current $1.98 trillion volume of outstanding debt has fallen from about $2.1 trillion a year ago, data compiled by Bloomberg show.

In Europe, the companies coming to market so far this year are “generally speaking the better quality end of high-yield, which you would expect to be the first in the queue for the refi wall the market faces,” abrdn’s Hickmore said.

©2024 Bloomberg L.P.