Oct 31, 2019

Kraft Heinz shares rise as higher prices underpin rebound

, Bloomberg News

Darren Sissons discusses Kraft Heinz

Kraft Heinz Co. investors are finally giving the company’s new chief the breathing room he needs to turn things around.

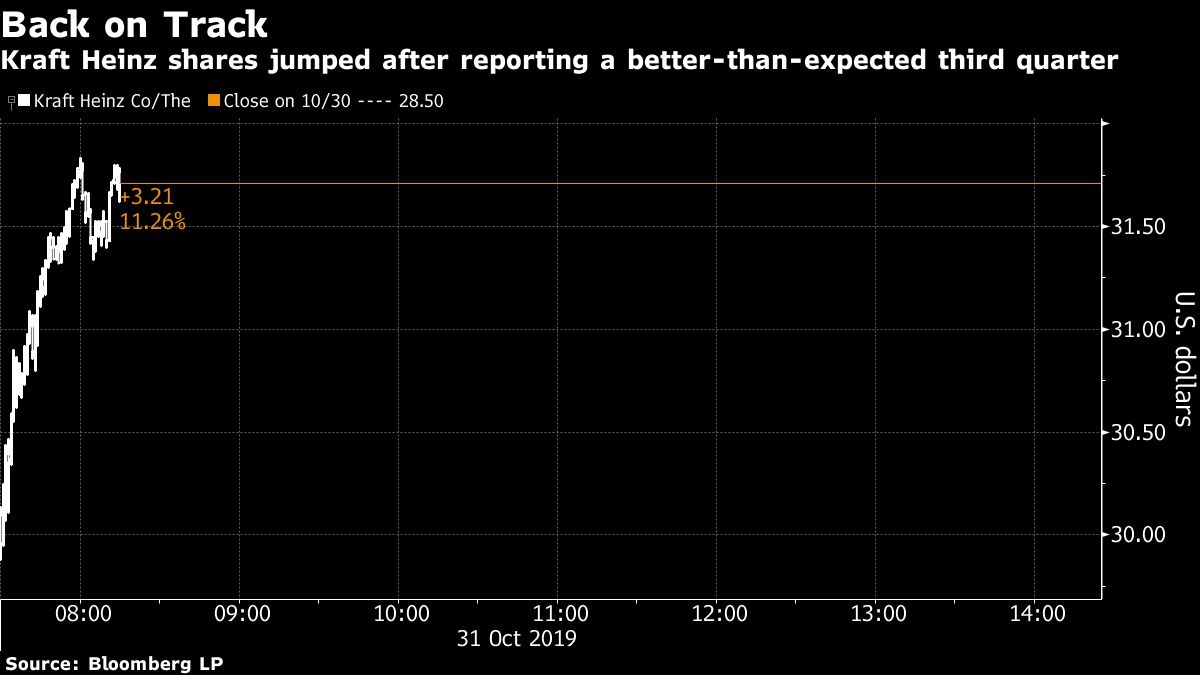

After pummeling the stock in August when Miguel Patricio said he hadn’t yet developed a “comprehensive strategy” just five weeks after taking the reins, shareholders cut him some slack after the company reported third-quarter profit that beat estimates on Thursday. The shares jumped up as much as 12%, the most intraday in more than two and a half years, as he started to formulate a vision for the struggling food maker. The stock reached its highest point since early August.

“Three months in and we are getting to deeply understand our business,” Patricio said in a conference call after reporting earnings, promising he’ll be “candid” and transparent when laying out the good and the bad. “We are not where we believe we can be, but we are excited with the evolution.”

The profit came amid higher prices for items like macaroni and cheese, Oscar Mayer cold cuts and Philadelphia cream cheese in the U.S. Kraft Heinz joins a slew of consumer-goods companies, such as Church & Dwight and Clorox, in hiking prices in recent quarters. Sales also outpaced analysts’ estimate, but still declined from a year earlier, underscoring the challenge Kraft Heinz faces as consumers abandon established brands for upstarts and new competitors.

Patricio is looking for a way forward for the maker of Heinz ketchup as consumers look for healthier, fresher foods. He said the third-quarter results “remain below our potential” — but investors were still heartened that the company seems to be formulating a path forward. Next year will be about stabilization, Patricio said, “to give us the time to be working on the pipeline for the future.”

Innovation ‘Frenzy’

He said too many new product launches added complexity to the company’s operations in recent years, adding that a “frenzy of innovation” sought to compensate for the decline in net sales. “We have not been successful on that,” he said.

Now, the food giant will focus on fewer projects with a wider scope, and it will spend more to market the products that drive profitability. It will also revamp product development to be “faster and more consumer-centric.”

Once again, Kraft Heinz didn’t offer guidance, but the company expects performance in the fourth quarter to be similar to the third quarter. Patricio said in August he didn’t have enough confidence to issue a forecast at that time, spooking Wall Street.

The share rise offers some redemption as a rough year starts to come to a close. In February, Kraft Heinz announced a US$15.4 billion writedown on its brands, weak profits and an SEC subpoena. Later in the year, an additional subpoena was announced related to procurement practices and it was forced to restate several years of earnings. In its August release, the company reported two new impairment charges totaling about US$1.2 billion.