Feb 15, 2023

Large IAA investor Discerene to vote against US$6B sale to Ritchie

, Bloomberg News

Janus Henderson opposes Ritchie Bros deal

One of the largest shareholders of IAA Inc. plans to vote against the company’s sale to Ritchie Bros. Auctioneers Inc., arguing that the price is too low and the deal doesn’t make strategic sense.

Discerene Group LP, holder of around 3.6 per cent of IAA shares, says the sale process “was fundamentally flawed and flies in the face of good corporate governance,” according to a letter to the board seen by Bloomberg News. IAA directors didn’t do enough to seek out other buyers, and at the price Ritchie is offering, the company would be better off staying independent, the investment firm said in the letter.

Ritchie, a seller of industrial equipment based near Vancouver, has offered about $6 billion in cash and shares for IAA, which auctions damaged and written-off vehicles. The deal ran into friction from the start: Ritchie’s share price tumbled 18 per cent on the day of the announcement in November, though it has since bounced back.

“The sale will force IAA shareholders to assume significant execution risks with an unproven management team, including the risks of attempting to integrate two very different businesses in very different industries and with very different business cultures,” Stamford, Connecticut-based Discerene Group said in the letter. “These attempts seldom end well.”

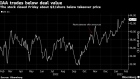

IAA fell 0.7 per cent to $43.55 at 10:04 a.m. in New York. That’s about $3 below the current value of the takeover bid based on Ritchie’s share price, which was up 0.2 per cent Wednesday.

'INCREDIBLY EXPENSIVE'

Last month, Ritchie sought to overcome opposition by changing the terms, offering more cash and less equity to IAA holders and promising a special divided to its own investors if the deal happens. To finance the new offer, the company accepted $500 million from Starboard Value LP, almost all of it in the form of convertible preferred shares.

Ritchie shareholders would own 59 per cent of the merged company, IAA holders 37 per cent and Starboard just less than 4 per cent on an as-converted basis.

Some Ritchie shareholders have criticized the Starboard deal as too generous to the activist investment firm led by Jeffrey Smith. Discerene agrees, calling it “incredibly expensive” financing that will harm other Ritchie shareholders.

An outside spokesperson for IAA said in an emailed statement: “We continue to believe that combining Ritchie Bros. and IAA’s marketplace capabilities will create a unique value proposition with significantly increased earnings power and shareholder value creation. This transaction brings together two strong companies and complementary business models across near-adjacent verticals with significant synergy potential, led by a highly experienced, engaged and respected management team and board.”

Discerene’s stake makes it one of IAA’s 10 largest holders, according to data compiled by Bloomberg.