Nov 16, 2020

Larry Berman: The quality of earnings growth globally remains weak

Presented by:

By Larry Berman

Global earnings growth remains weak: Larry Berman

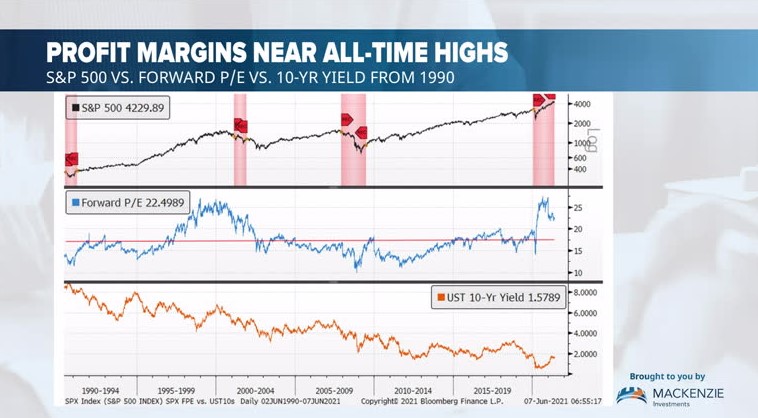

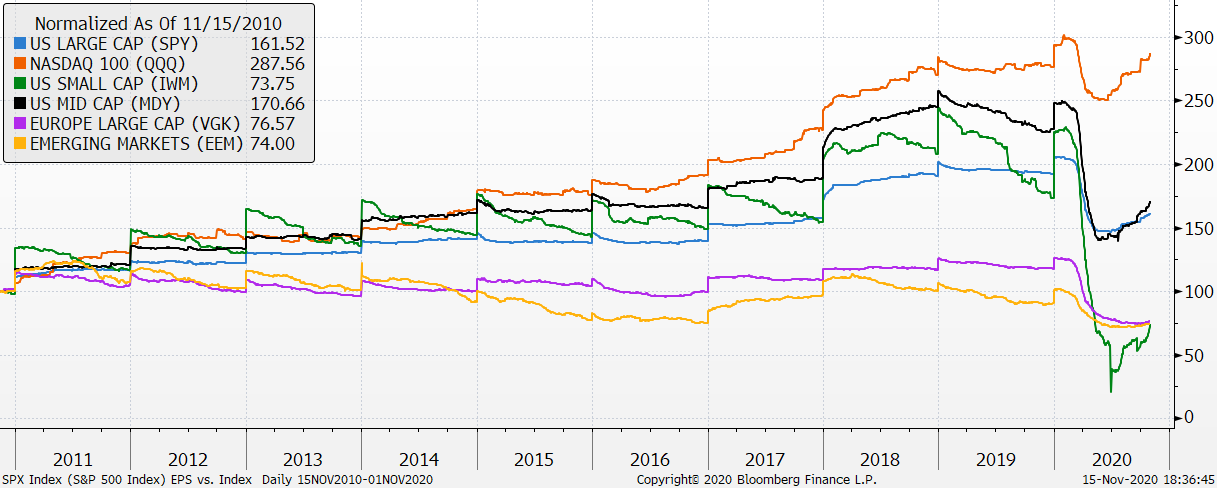

Over the past decade, outside of a handful of large technology companies, earnings per share (EPS) growth has, in part, been a function of financial engineering by way of share buybacks. All this is made possible by low interest rates. As governments continue to pile on debt and artificially keep interest rates low, this can continue, and will based on what central banks are telling us.

Is it fundamentally bullish? No way! Can stocks keep responding? Yes, they can! When we look at Europe (VGK) and Emerging Markets (EEM) EPS growth in the past decade, there isn’t any. I mean zero, nada, die null. More than ever before, the markets are very sensitive to interest rates.

When we look for markets that have delivered EPS growth, we see the NASDAQ as the standout. A huge percentage of that was share buybacks and tax cuts after 2018. They are also less impressive when we look at GAAP earnings. When we strip out that concentrated earnings growth – earnings growth in the U.S. that has beaten the rest of the world – most of the market growth has come from multiple expansion (largely due to the low-rate environment). This begs the question, with low rates in Japan and Europe, why have their markets not responded? It looks like they are starting to, as the large-cap technology stocks driving the U.S. markets are very expensive.

When we look at the yield that the typical 60:40 balanced portfolio offers (Based on U.S. data, as Canada is a bit higher on equities and a bit lower on bonds), the median (dividend plus interest) return historically is more than four per cent. Today, it’s never been lower. The markets are extremely sensitive now to interest rates since that has been the primary driving factor over the past decade, as central banks use their balance sheets to keep the economy going. I would argue that the moral hazard in markets has never been higher.

Don’t miss the current Berman’s Call virtual roadshow. If you missed one, you can see all the replays here. Sign up for the series at www.etfcm.com every Thursday at 7 p.m. ET through Dec. 3. There will be many opportunities to ask questions about markets and your favourite ETFs and stocks.

Subscribe to my new YouTube channel Larry Berman Official, which is the new site for all our educational content and my new weekly market recap and ETF bull and bear picks of the week. Look for a series of option-based educational videos in 2021.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com