Oct 23, 2022

LDI Chaos Likely to Hurt Private Equity and Property Allocations

, Bloomberg News

(Bloomberg) --

The UK market turmoil triggered by a gilt-linked derivatives strategy is bad news for allocations to everything from private equity to real estate.

The volatility left pension pots nursing heavy mark-to-market losses, forcing them to unload everything from government bonds to securitized debt. That’s spurring a rethink for European retirement funds after they amassed illiquid assets in the cheap money era, according to PensionsEurope, an industry group whose members have a combined assets of more than 7 trillion euros ($6.9 trillion).

That would mark a sharp reversal after they spent years chasing private assets in pursuit of yields that would match their long-term liabilities. About a quarter of global pension fund holdings are made up of alternatives such as private credit and infrastructure compared with 7% 20 years ago, according to consultancy Willis Tower Watson.

Alternatives take longer to sell, however, meaning less liquidity during periods of turmoil such as those triggered in recent weeks by liability-driven investment strategies. Those products are used by pension firms to match their liabilities to their assets through the use of derivatives.

Illiquid Assets

“What happened in the UK has prompted some pension funds in Europe to reassess their holdings of illiquid assets because, at the time of heightened volatility, this could present a problem,” said Matti Leppala, the chief executive officer at PensionsEurope.

While there are no solvency issues, Leppala said, this is “about having proper liquidity and risk management in place.” A surge in gilt yields “of this magnitude was unexpected” and “is a lesson learned.”

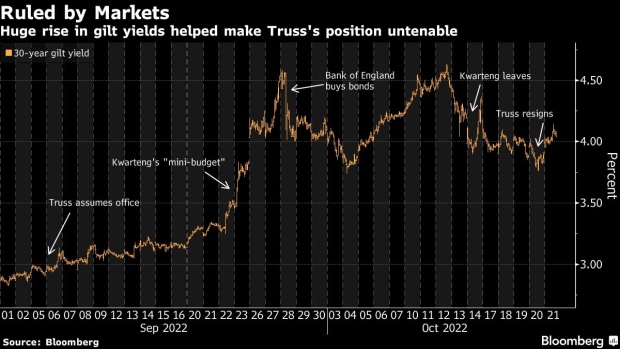

UK government bond yields soared after the country’s uncosted mini budget caused huge mark-to-market losses for those using LDI strategies, forcing funds to sell off assets to meet margin calls. The losses may have reached £150 billion since early August, leading the Bank of England to intervene to prevent the contagion from spreading.

The fire sales primarily involved government bonds, Leppala said, providing a crucial reminder that liquidity can easily dry up during periods of stress, even for assets that are otherwise the easiest to trade. As a result, pension funds are mulling caps on illiquid assets, he said.

Leppala is the latest finance industry figure to warn that the LDI saga could point to wider dislocations in markets as inflation rises and quantitative easing comes to an end.

Further Volatility

Paul Marshall, the co-founder of Marshall Wace LLP, said that the crisis is “the first casualty of the ‘money for nothing’ era.” Fellow hedge fund managers Crispin Odey and Alberto Gallo have also warned that further volatility could come as central banks raise interest rates after keeping them artificially low for years.

“I wouldn’t be surprised as rates move up” if other forced sellers emerge “as pressure grows in the system,” Blackstone Inc. President Jonathan Gray told investors on Thursday.

When it comes to LDI, Leppala stresses that the exposure of the euro area pension funds is relatively small. The exception for the Dutch pension funds which have liabilities of about 1.4 trillion euro ($1.2 trillion), but typically have lower leverage than their UK counterparts.

Leppala estimates that a two percentage point increase in interest rates in the euro region would trigger a 82 billion euro margin call on Dutch pension funds. Traders are pricing in a move of that magnitude by March of next year.

Liabilities Fall

Leppala also points out that pension funds likely saw an even bigger drop in the value of their liabilities as rates climbed, which is good for overall soundness. That chimes with BT Group Plc’s pension fund, which saw asset values fall about 11 billion pounds in recent weeks without worsening their funding position.

“If – as seems evident so far – Europe avoids the self-reinforcing dynamics of the recent gilt volatility, we think it likely that there will be further action to mitigate risks,” Simon Freycenet, a strategist at Goldman Sachs Group Inc. wrote in a note to clients. “First, liquidity buffers will likely be boosted, and leveraged exposure to duration will likely be reduced.”

--With assistance from Greg Ritchie.

©2022 Bloomberg L.P.