Oct 18, 2022

Lockheed Gains Most Since 2020 on Profit Beat, Buyback Plan

, Bloomberg News

(Bloomberg) -- Lockheed Martin Corp.’s shares rose the most in more than two years after the defense contractor reported profit that beat Wall Street’s estimates and increased its share repurchase plans by $14 billion.

Adjusted earnings in the third quarter were $6.87 a share, Lockheed said Tuesday in a statement. That topped the $6.72 average of analyst estimates compiled by Bloomberg. Cash flow from operations surged 62% to $3.13 billion, beating projections.

The maker of the F-35 is benefiting from heightened global volatility amid Russia’s invasion of Ukraine, unrest in the Middle East and rising US tensions with China. Chief Executive Officer James Taiclet said on a conference call that demand for its Javelin missile system has been particularly strong in recent months.

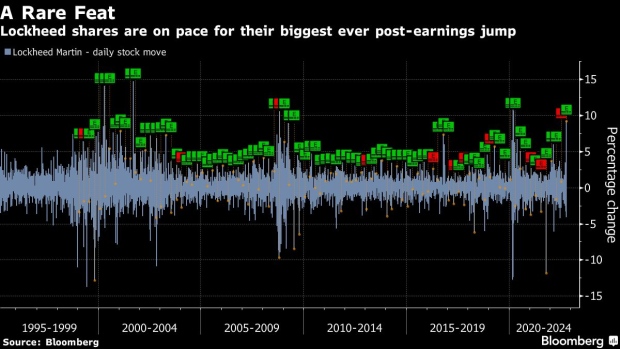

Lockheed shares climbed 8.7% to close at $431.84, the biggest one-day jump since March 2020. The stock, which is up 22% this year, was the second-best performer in the S&P 500 Index on Tuesday after Carnival Corp. Rivals including Raytheon Technologies Corp. and Northrop Grumman Corp. also rose.

Lockheed’s net sales in the quarter narrowly missed analysts’ estimates. The company reaffirmed its revenue and profit forecasts for 2023.

The Bethesda, Maryland-based company said it would buy back $4 billion of shares in the fourth quarter in an expanded repurchase program, which is expected to be executed over a three-year period.

(Updates with closing shares in fourth paragraph.)

©2022 Bloomberg L.P.