Apr 22, 2024

London Bankers Inch Closer to New York-Style Bumper Bonuses

, Bloomberg News

(Bloomberg) -- Some of London’s top bankers might soon have a paycheck that looks more like the bonus-heavy packages of their New York counterparts.

It’s been six months since the UK lifted a cap on bankers’ bonuses that had effectively limited such payments to two-times their base salary. Now, a slew of the country’s biggest lenders are asking shareholders for permission to rewrite their bylaws in a way that would allow them to adjust how they structure pay for legions of their best investment bankers and traders.

Proposals touching on the issue will be up for debate at annual shareholder meetings held by HSBC Holdings Plc and Barclays Plc in the coming weeks. Top proxy advisers Institutional Shareholder Services and Glass Lewis have recommended investors approve the proposals at both banks, a sign that they’re likely to pass.

If they pass, managers across London’s finance industry will be able to begin the process of rejiggering bonuses for their traders and investment bankers. In places like New York, these bonuses can stretch into millions of dollars and are many multiples of bankers’ and traders’ annual salaries. Wall Streeters spend months banking on their bonuses to pay for elite private schools, luxury vacation homes and private-club memberships.

It’s not just UK banks that have been affected by Britain’s scrapping of the ban. US banks including JPMorgan Chase & Co. and Goldman Sachs Group Inc. are also reviewing their pay policies for London staffers.

“This payround, people will expect generous pay increases,” said Ranjit Dhindsa, who leads the employment, pensions, immigration and compliance practice at the law firm Fieldfishers. “The market is fluid again and people are confident about moving jobs.”

The bonus cap was first introduced by the European Union back in 2014 in response to public outcry about the financial crisis. In October, following years of industry lobbying, UK officials scrapped the cap as part of a broader push to make post-Brexit Britain more attractive as a financial center.

The cap was structured in such a way that banks’ so-called material risk takers — which can be investment bankers, traders, risk managers or even compliance personnel — could earn variable compensation that was equal to their fixed salary. With shareholder approval, though, bonuses could reach a maximum of twice a banker’s base pay.

That’s meant that many UK lenders now need investors to sign off again before they could start adjusting paychecks. That’s partly why regulators’ move last year didn’t immediately open the floodgates to higher bonuses across the industry.

With those meetings taking place in the coming weeks — and the proposals before investors largely expected to pass — managers across London’s financial firms will soon begin the process of reworking pay structures for their best bankers and traders.

Banks have warned that there will be challenges to adopting this new form of compensation since many had already upended their payment structures to accommodate the cap.

In one high-profile example, Citigroup Inc. awarded Paco Ybarra, the London-based executive who led the firm’s unit that included trading and investment banking, $8.05 million in fixed pay for his work last year, compared to the $1.5 million base salary that Chief Executive Officer Jane Fraser received. That allowed Ybarra’s total compensation of $20 million to fit within the bonus cap rules.

“Removing the bonus cap may have unintended consequences,” said Peter Swabey, policy and research director at the Chartered Governance Institute UK & Ireland. “Some organizations tried to bypass the cap by increasing base salary,” he said, noting that “they may find the conversation about reducing fixed salary uncomfortable, especially as many executives place less value on the uncertain than the certain.”

Still, the ability to boost bankers’ and traders’ pay will come just as lenders look to those units for growth in the coming quarters.

Revenue from fixed-income and equities trading at five of the largest US banks beat analyst estimates for the first quarter. The group also produced revenue from debt and equity underwriting that topped expectations.

As the UK’s largest lenders report first-quarter results of their own in the coming weeks, they’re also expected to benefit from a rebound in capital markets activity. Those hauls should help ease the blow as the industry experiences a slowdown in net interest income.

CEO Pay

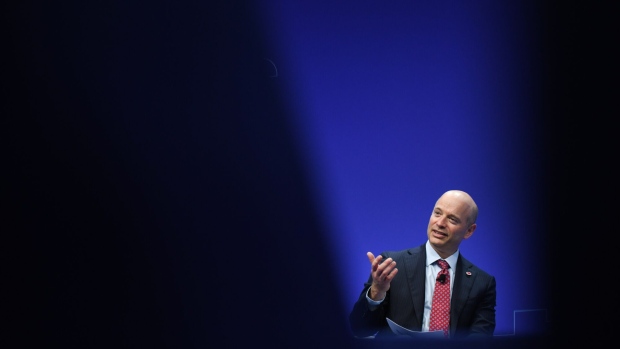

It’s not just banker pay that’ll be on the docket in upcoming annual shareholder meetings. Investors will also be asked to vote on pay packages for the industry’s top executives, including a proposal at London Stock Exchange Group that could double Chief Executive Officer David Schwimmer’s pay and turn him into one of the highest-paid CEOs in the UK.

With the changes, Schwimmer could be handed as much as £13.2 million ($16.7 million) for his work this year, up from a maximum of £6.35 million in 2023, according to Glass Lewis. The proxy adviser questioned the scale of such a raise and said it would prefer to see increases doled out over time.

LSEG has already consulted with roughly 100 shareholders about the proposal. As the company’s board was debating how big of a pay package to hand to Schwimmer, it considered the fact that many of its top executives have been recruited away in recent quarters, including Chief Financial Officer Anna Manz and Chief Operating Officer David Shalders.

“We are focused on securing and retaining the calibre of talent required in a highly competitive global market whilst ensuring delivery of strong performance is rewarded,” a spokesperson for the company said in an emailed statement.

Pay Battles

LSEG isn’t alone. AstraZeneca Plc’s Pascal Soriot will receive a maximum of almost £19 million this year, up from £16.8 million, in a move that drew criticism from a bevy of shareholders. Smith & Nephew Plc, a medical device maker, has also proposed giving a pay increase to CEO Deepak Nath, arguing the move will “ensure the company is led by a first class management team.”

Top bosses from across the City of London, including LSEG’s Julia Hoggett, who leads the company’s London Stock Exchange division, have long complained that the UK’s restrictions on executive pay hinder companies’ efforts to recruit top talent. Many corporate governance experts disagree.

“The idea that the UK suffers from a brain-drain to the USA is special pleading,” Swabey said. “Executive bonuses are not a magic wand that can transform a company, and they are no substitute for serious transformation efforts, on which boards should focus.”

The differences are stark, though. Median pay for FTSE 100 CEOs have reached £3.91 million, according to a 2023 report from the High Pay Centre think tank. While that’s a 16% increase from a year earlier, it compares with the $22.3 million average of CEO pay for the largest US-listed companies at that time.

“We should be encouraging and supporting UK companies to compete for talent on a global basis,” Hoggett said in a blog post last year. “The alternative is we continue standing idly by as our biggest exports become skills, talent, tax revenue and the companies that generate it.”

©2024 Bloomberg L.P.