Mar 6, 2019

Loonie drops to two-month low after Bank of Canada changes tone

, Bloomberg News

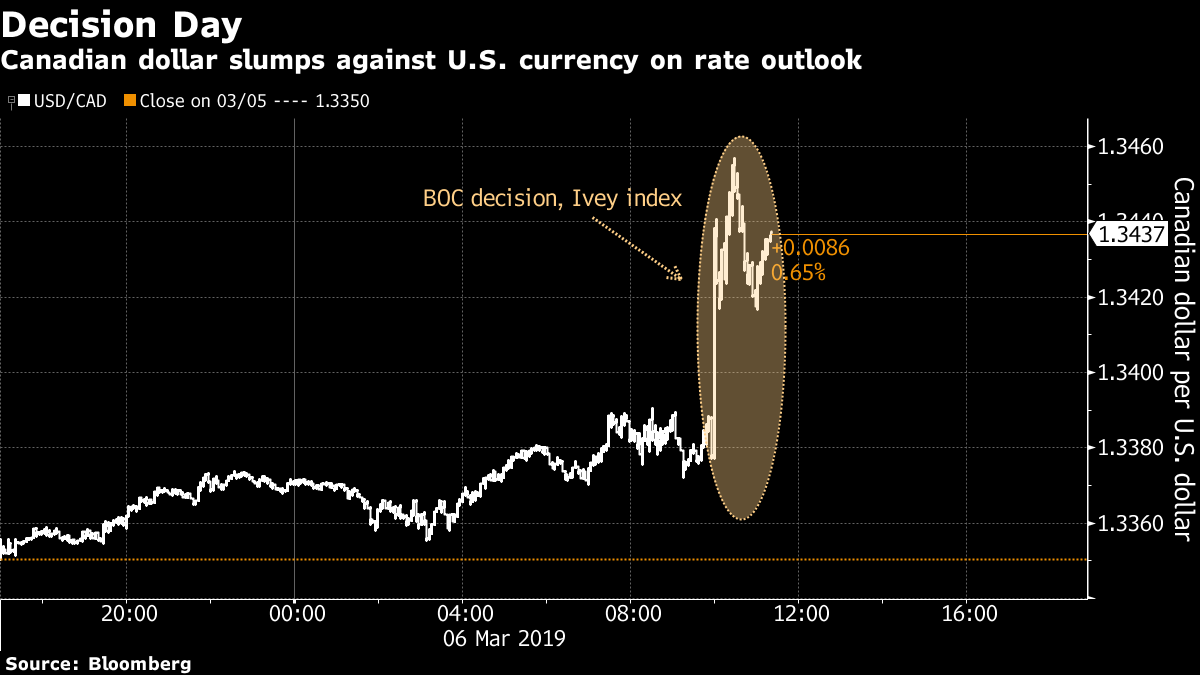

The Canadian dollar tumbled to the weakest level since the opening days of 2019, and the nation’s government-bond yields sank, after the Bank of Canada dropped its assertion that interest rates need to rise amid signs of slowing economic growth.

The loonie fell 0.7 per cent to $1.3439 per U.S. dollar, touching the weakest since Jan. 4 and paring its 2019 advance to 1.5 per cent. Yields on two-year Canadian government bonds dropped 8 basis points to 1.66 per cent, the lowest since December. That drove the spread to similar-maturity Treasuries to 86 basis points, the widest since 2007.

The BOC left its benchmark rate at 1.75 per cent Wednesday, as expected, and cited “increased uncertainty about the timing of future rate increases.” Traders have now all but ruled out a rate hike this year and see a 15 percent chance of a cut by July, data compiled by Bloomberg show. A report showing weakening manufacturing on Wednesday magnified the worsening economic outlook.

“They sound less convinced about the next hike,” said Win Thin, global head of currency strategy at Brown Brothers Harriman. “If the data continues to come in weak, they may have to switch to a neutral bias. The data has added to the gloom.”

The central bank’s dovish tilt came after fourth-quarter data released last week showed the economy practically ground to a halt.

If the currency pair sustains a move above the $1.3435 area, it may test the roughly 1 1/2-year high of $1.3665 touched Dec. 31, Thin said.

The loonie wasn’t the only commodity-related currency under pressure Wednesday. Australia’s dollar slid 0.9 per cent to 0.7021, a two-month low.

The decline came on disappointing gross domestic product data, and as Reserve Bank of Australia chief Philip Lowe said it’s hard to envision a scenario where the central bank needs to raise rates this year.