Oct 2, 2023

Morgan Stanley Turns Bearish on Egypt, Warns Risks Building

, Bloomberg News

(Bloomberg) -- Morgan Stanley is turning bearish on Egypt as the cash-strapped nation faces what the US bank called “mounting risks” in the coming months.

Egypt’s sovereign credit has been moved to a “dislike stance” from a “neutral” rating by Morgan Stanley. The decision was part of a report in which the bank removed its preference for higher-yielding emerging-market debt over investment-grade securities, saying the increase in US inflation-adjusted yields has reduced the relative attractiveness of riskier assets.

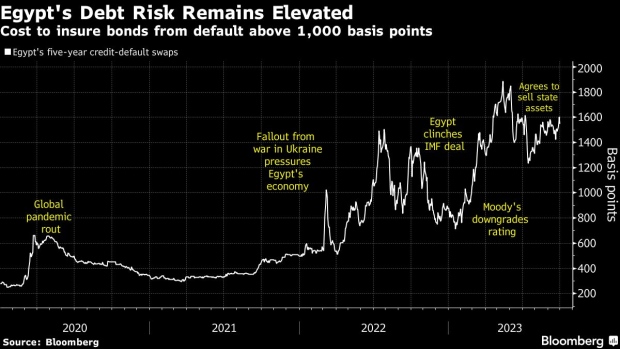

Looming presidential elections in December will complicate Egypt’s ability to push through reforms — including moving to a flexible exchange rate, a key condition in a $3 billion International Monetary Fund program, Morgan Stanley strategists said. There’s also the threat of a downgrade from Moody’s Investors Service that could send the rating deeper into junk and lead to “some forced selling,” they said.

“In the near term, we think that Egypt lacks a positive catalyst, leaving us disliking the credit,” strategists including James Lord and Neville Mandimika wrote in a note on Monday.

Egypt has lost favor with foreign portfolio investors who once saw it as a prime destination for hot money that kept its currency stable and boasted some of the world’s highest interest rates when adjusted for prices. But sentiment turned sharply against riskier assets with the Russian invasion of Ukraine last year, forcing several rounds of devaluation in Egypt that touched off inflation.

The prospect of a prolonged period of elevated rates in the US may now keep Egypt locked out of global capital markets for longer. The nation’s financing needs remain high at $24 billion in the fiscal year through June 2024, according to Morgan Stanley, and the amounts it’s getting from foreign direct investments, portfolio inflows and asset sales have been disappointing.

“The long-term drag on the credit remains the high financing needs this year into next year, particularly at a time when market access remains uncertain for single-B credits like Egypt,” the strategists said.

Egypt’s dollar debt has lost about 11% this year, the worst performer across emerging markets after Bolivia and Ecuador, according to Bloomberg indexes. Many of its bonds are in distressed territory, with the extra yield investors demand to buy Egyptian dollar bonds rather than Treasuries at 1,211 basis points on Friday.

Egyptian President Abdel-Fattah El-Sisi confirmed on Monday he’ll seek a third term in the Dec. 10-12 election in which the plight of the economy and the impact of soaring prices on the country of 105 million people will likely take center stage.

Beyond this year, investors’ focus will shift to Egypt’s syndicated loans due in the second half of 2024, including two facilities worth a combined $5 billion it secured from banks in the United Arab Emirates, the strategists said.

These loans will likely be rolled over given signs that Gulf Arab countries are “willing to support Egypt in a bid to maintain financial stability,” they said.

“For now, we move to a dislike stance in light of the near-term risks amid limited market access,” the strategists said.

(Updates prices in eighth paragraph, adds El-Sisi’s re-election bid in ninth.)

©2023 Bloomberg L.P.